If you are an absentee owner, an absentee owner surcharge applies to taxable Victorian land you own. The surcharge is an additional amount that applies over the land tax you pay at general and trust surcharge rates.

This surcharge is 4% from the 2024 land tax year (previously 2% for the 2020-2023 land tax years, 1.5% for the 2017-2019 land tax years, and 0.5% for the 2016 land tax year).

An absentee owner includes an absentee trust. If you are the trustee of an absentee trust that owns taxable land on 31 December, you must tell us that you are an absentee owner before 15 January of the following year. This is important because penalties may apply if you don’t tell us.

What is an absentee trust?

An absentee trust can be a discretionary trust, a unit trust or a fixed trust, which has at least one beneficiary who is an absentee person. In the case of a:

- discretionary trust, the trust has at least one 'specified beneficiary' who is an absentee person.

- unit trust, the trust has at least one unitholder who is an absentee person.

- fixed trust, the trust has at least one beneficiary who is an absentee person and has a beneficial interest in land held subject to the trust.

The absentee owner surcharge does not apply to excluded or administration trusts.

Tracing through chains of trusts

If a beneficiary of a trust (the first trust) is a trustee of another trust (the second trust), you have a chain of trusts, which can have 2 or more layers of trusts.

When determining whether the first trust is an absentee trust, you must look through all the trusts in the chain of trusts. For example, if a beneficiary of the second trust is an absentee person, the second trust and the first trust will both be absentee trusts.

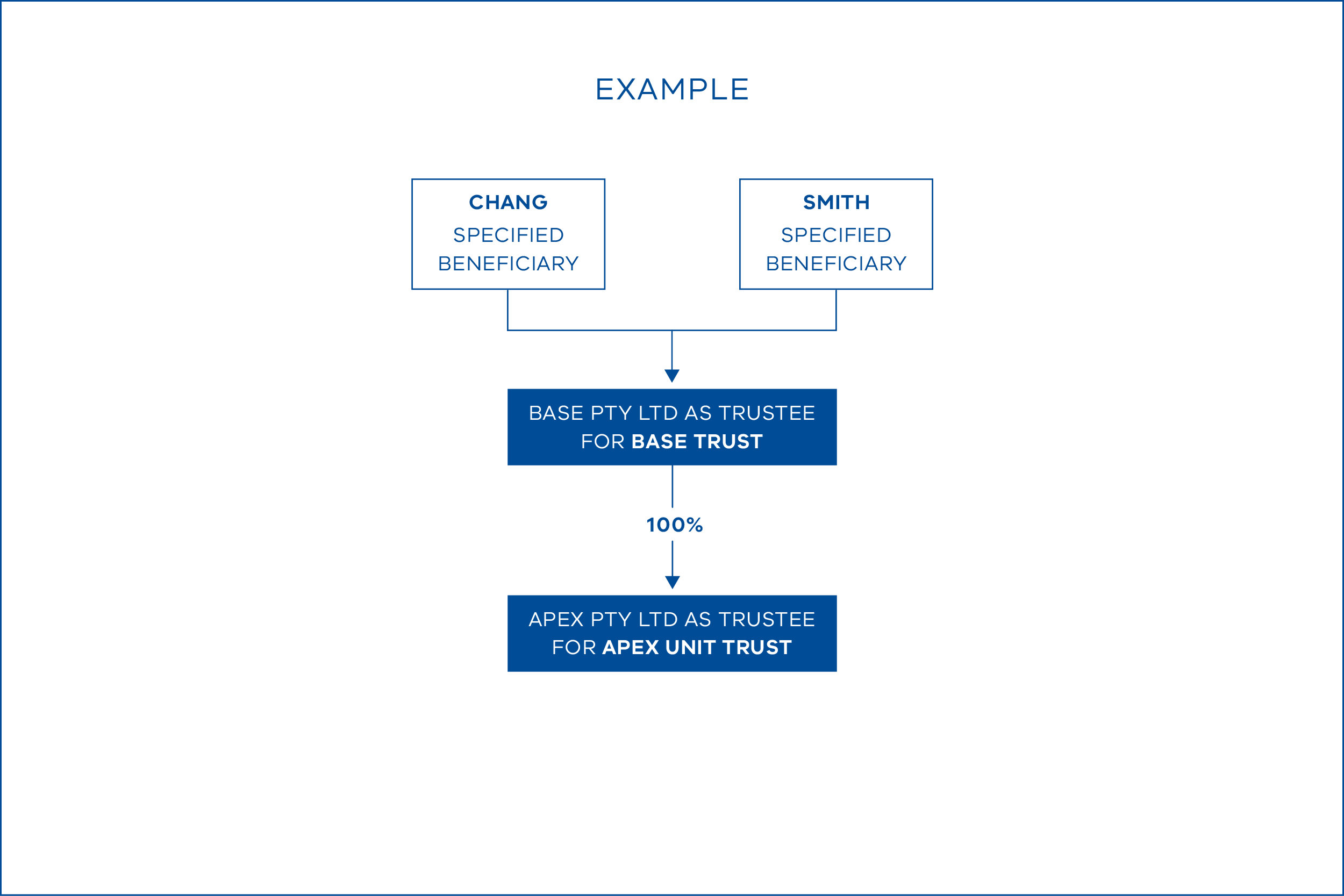

Apex Pty Ltd is trustee of the Apex Unit Trust and owns taxable land in Victoria. The units in the Apex Unit Trust are held by Base Pty Ltd as trustee of the Base Trust, which is a discretionary trust. The specified beneficiaries of the Base Trust are both absentee individuals.

The Base Trust is an absentee trust because it has at least one specified beneficiary who is an absentee person. The Apex Unit Trust, in turn, is an absentee trust because its unitholder is an absentee person. Therefore, Apex Pty Ltd, as trustee of the Apex Unit Trust, will be liable for the absentee owner surcharge.

From the 2018 land tax year, the way the absentee owner surcharge is calculated has changed where there is a chain of trusts.

Exemption for an absentee trust

An absentee beneficiary in relation to an absentee trust may, in some circumstances, be eligible for an exemption with effect from the 2018 land tax year. The effect of the exemption is that the absentee beneficiary is taken to be a beneficiary who is not an absentee beneficiary. The result is the trust will not be considered an absentee trust, and therefore will be exempt from the absentee owner surcharge.

The exemption is intended to apply to trustees of absentee trusts which are Australian-based, and whose commercial activities make a significant contribution to the Victorian economy and community by engaging local labour and using local materials, and exhibit good corporate behaviour. The exemption is not intended to apply where the trustee of an absentee trust is merely a property investor or landlord.

The Treasurer's guidelines, published in the Government Gazette, outline the basis on which exemption decisions are made. Before you apply, you should refer to the relevant guidelines to determine whether you are eligible for the exemption:

- For exemption applications relating to the 2018 land tax year, refer to the Treasurer's guidelines issued on 5 January 2018.

- For exemption applications relating to the 2019 land tax year onwards, refer to the Treasurer's guidelines issued on 1 October 2018. These guidelines were issued to include examples of how build-to-rent developments may qualify for the exemption. The exemption will cease to apply when the build-to-rent development is completed, as the absentee corporation or the trustee of the absentee trust will then be considered a passive investor or landlord.