The land you own and occupy as your home is your principal place of residence (PPR) and is exempt from land tax.

Generally, we know when a property is your PPR because you tell us in the Notice of Acquisition of an Interest in Land (NOA) form, which you complete and lodge with Land Use Victoria when you acquire property. Land Use Victoria provides this information to us so we know about the change in land ownership and can apply the exemption.

If a property you own becomes your PPR in other circumstances, you can apply for a PPR exemption.

You can update property ownership information, including applying for a PPR exemption or another exemption, online via My Land Tax or by calling us on 13 21 61.

When you no longer occupy the land as your PPR, the exemption should be removed and land tax may apply. It is your responsibility to notify us of a change of circumstance or penalties and interest may apply.

Generally, you can only claim one PPR exemption anywhere in Australia at a time, although there are limited exceptions to this rule.

The exemption is also available for land:

- owned by eligible trustees

- used as a PPR by a person with a qualifying disability who is an immediate family member of the owner

- used as a PPR by a person granted a right to reside on the land under a will or testamentary instrument

- used as a PPR by a person with a life interest in the land.

The PPR exemption does not apply to land owned by companies, body corporates and other organisations even if the land is occupied by any of the shareholders or members of the company or organisation.

It also does not apply to land owned by natural persons who occupy it as a PPR and are:

- trustees or beneficiaries of a trust (including an implied or constructive trust) to which the land is subject, or

- a unitholder in a unit trust scheme to which the land is subject.

Apply for a PPR exemption from land tax

Who else can claim a PPR exemption?

Eligible trustees

This type of PPR exemption is generally only available for land:

- owned by trustees of certain trusts, and

- used and occupied as the PPR of a vested beneficiary, who is a natural person with either a vested beneficial interest in the land (such as under a fixed trust) or the principal beneficiary of a special disability trust.

Trustees eligible for the PPR exemption also include trustees:

- of a fixed trust or bare trust for a person who uses and occupies the land as their PPR

- of a trust under a will and used and occupied by one or more persons with a right to reside granted under the terms of the will

- appointed in accordance with a will for a life tenant who uses and occupies the land as their PPR.

The exemption is not available for land owned by a trustee of a discretionary trust, a unit trust scheme or a liquidator. However, concessionary tax treatment is available for land held by a trustee of a discretionary trust or a unit trust scheme which is occupied by a beneficiary as their PPR where the trustee nominates that person as the PPR beneficiary. The exemption does not apply, however, if land is held by a fixed trust and the vested beneficiary pays rent to the trustee for residing at the trust land as the beneficiary’s PPR.

For land held by fixed trusts or joint ownerships, the exemption can only apply to the share held by an owner or beneficiary who uses the land as their PPR.

The exemption is also not available for land owned by trustees of implied or constructive trusts.

A person with a qualifying disability

An exemption is available where land is owned by an immediate family member of a person with a qualifying disability and the land is used as a PPR by that person with a qualifying disability.

A special disability trust is not actually required to be established to receive this exemption. There is a separate PPR exemption where a special disability trust has been set up and a principal beneficiary uses and occupies the land as their PPR.

The exemption is only available for the 2024 land tax year onwards.

To be eligible for the exemption, the following conditions must be met:

- The landowner is an immediate family member of the person with a qualifying disability. An immediate family member includes a natural parent, adoptive parent, step-parent, legal guardian, grandparent or sibling, but does not include children.

- The person with a qualifying disability has used and occupied the land as their PPR in the year preceding the tax year.

- No rent has been paid by or on behalf of the person with a qualifying disability for residing at the land as their PPR.

- The person with a qualifying disability has received a determination in writing from Services Australia or the Department of Veterans' Affairs that they meet the impairment of disability conditions for a special disability trust. The exemption can only apply in the land tax year following the approval date on such a determination. However, where the approval date is in the 2024 calendar year, the SRO will allow the exemption to apply in the 2024 land tax year given this is the first year for this new exemption.

Unless you meet the conditions 1 to 3 above, do not contact Services Australia to obtain their determination. In addition, please check the eligibility criteria for the principal beneficiary of a special disability trust before you proceed.

For information about applying for a special disability trust, including undertaking an assessment against the impairment and disability conditions to meet condition 4 above, you will need to contact Services Australia on 132 717. Further information on special disability trusts can be found on the Services Australia website.

To receive this exemption, the landowner should apply to the SRO.

Right to reside under a will or testamentary instrument

Where the land is used as a PPR by a natural person who has been granted a right to reside there under a will or testamentary instrument, these requirements must also be satisfied for a PPR exemption to apply:

- immediately before the person was granted a right to reside on the land, the land was the PPR exempt land of the deceased

- the right to reside was not granted or acquired in exchange for monetary consideration

- the person who has the right to reside does not have another PPR in Victoria or elsewhere.

Life estates

If a person who is granted a life estate under a will or other way uses and occupies that land as their PPR, the exemption is available.

Deceased estates

Where the individual owner or the vested beneficiary who was using the land as their PPR dies, the exemption continues to apply to that land until the earlier of:

- 3 years after the death of the individual owner or vested beneficiary, or a further period approved by the Commissioner of State Revenue

- the interest of the individual owner or vested beneficiary is given to another person under a trust

- the land is sold or transferred to a new owner.

This exemption ceases if the land is rented out following the death of the former owner or vested beneficiary.

This exemption does not apply after the death of the resident who was residing on the land under either a right to reside or a life estate in possession or to a person with a disability (qualifying) who was residing on land owned by an immediate family member.

What are the requirements of a PPR exemption?

To be eligible for the exemption, certain land and occupancy requirements must be satisfied.

Land requirement

There must be a building affixed to the land which is designed and constructed primarily for residential purposes and can lawfully be used as a place of residence. For newly built homes, this means the certificate of occupancy must have been issued.

The exemption is generally only available for one parcel of land that is your principal residence. Therefore, if you own more than one parcel of land and you live on each land during the year, only one of these lands can be your PPR.

This means that if you have other land in Australia that receives a PPR exemption, the Victorian land tax exemption will generally not be available.

If your PPR is a building affixed to more than one land that you own because it straddles the boundary of those lands, or if you live in apartments that comprise multiple property titles but together they constitute your PPR, then the exemption will apply to each of those lands.

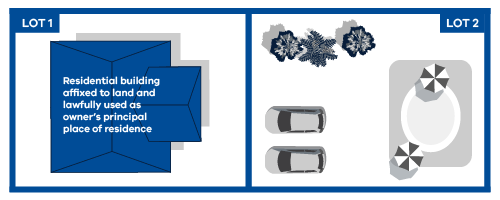

Example 1

Dimitri owns lot 1 and lot 2, which are contiguous lands on separate titles. His residence straddles both lots and therefore both lots are eligible for the exemption.

Example 2

Patel owns lot 1 and lot 2, which are contiguous lands on separate titles. Her residence is built on lot 1 and therefore only lot 1 is eligible for the exemption. Lot 2 may be eligible for exemption if it meets the conditions for land contiguous to the PPR.

Occupancy requirement

Where the landowner is an individual owner or eligible trustee, that landowner or the vested beneficiary of the eligible trust must live on the land for at least 6 months from 1 July of the year before the assessment to be eligible for the exemption.

We may defer the payment of land tax for 6 months if the landowner or vested beneficiary is unable to meet this requirement because either:

- they started occupying the land on or after 1 July of the year before the assessment

- the land was purchased on or after 1 July of the year before the assessment and they did not start living on it in the year before the assessment.

After that 6-month period, provided the land has been continuously used as a PPR by an individual owner or vested beneficiary, an exemption will apply to that land for the relevant assessment year.

Example 1

Jorge continuously uses land as his PPR for 6 months from 1 September 2024 to February 2025. The land would be exempt for the 2025 assessment year.

Example 2

Wei-Ai purchased a property in November 2024, but only started living in it on 2 February 2025. By 2 August 2025, she had continuously used the land as her PPR for 6 months. The land would be exempt for the 2025 assessment year if she did not occupy any other land she owns as her PPR between the dates that she is claiming the exemption.

If you need to defer your land tax assessment until you are able to live on the land continuously for 6 months, call us on 13 21 61 (please have your assessment on hand).

Can I receive the exemption on more than one property?

Not usually, however the PPR exemption may be available for more than one property if the land is contiguous to (adjoining) the PPR. It may also be available if the individual owner or vested beneficiary is moving between residences following the recent purchase of a new residence or sale of the previous residence.

Exemption for land contiguous to your PPR

The exemption can extend to contiguous land owned by the individual owner or eligible trustee which is on a separate title. Contiguous land must adjoin the PPR land or be separated by only a road, railway or something similar that you can reasonably move around or across. The contiguous land must not contain a separate residence, and must:

- enhance the PPR land, and

- be used solely for the private benefit and enjoyment of the individual owner or the vested beneficiary living on the PPR land.

A separate residence is a building affixed to the land that is capable of separate occupation. Accordingly, if the contiguous land contains a house or granny flat, the exemption cannot extend to the contiguous land. A building without all the amenities of an ordinary home, such as kitchen and bathroom facilities, is not considered a separate residence for the purpose of the exemption.

Examples that may qualify for this exemption include contiguous land containing a pool, tennis court or garden, provided there is no separate residence.

Changes from the 2020 land tax year

From 1 January 2020, this exemption is limited to:

- land that is contiguous to your PPR if both are located entirely in regional Victoria

- where an apartment or unit in metropolitan Melbourne that is a PPR has a separately titled car park and/or storage space, the exemption may also apply to that car park and/or storage space.

What does this mean for land in metropolitan Melbourne?

If your PPR is in metropolitan Melbourne, it is unlikely you will receive the contiguous land exemption, even if you previously did so. The exemption will only apply where your PPR is an apartment or unit with a separately-titled car park and/or storage space.

From the 2020 land tax year, we assess the contiguous land for land tax unless you have consolidated the land containing your PPR and the contiguous land into a single title.

For more information about consolidating contiguous titles, contact Land Use Victoria.

What does this mean for land in regional Victoria?

If your PPR and the contiguous land is wholly in regional Victoria, these changes will not affect you. The exemption will continue to be available.

If your PPR is in regional Victoria, and you have multiple contiguous lands inside and outside of regional Victoria, the exemption will only apply to those lands wholly in regional Victoria.

Regional Victoria means the regional councils listed below and the 6 alpine resorts of Mt Baw Baw, Mt Buller, Mt Hotham, Mt Stirling, Falls Creek and Lake Mountain.

- Alpine Shire Council

- Ararat Rural City Council

- Ballarat City Council

- Bass Coast Shire Council

- Baw Baw Shire Council

- Benalla Rural City Council

- Buloke Shire Council

- Campaspe Shire Council

- Central Goldfields Shire Council

- Colac Otway Shire Council

- Corangamite Shire Council

- East Gippsland Shire Council

- Gannawarra Shire Council

- Glenelg Shire Council

- Golden Plains Shire Council

- Greater Bendigo City Council

- Greater Geelong City Council

- Greater Shepparton City Council

- Hepburn Shire Council

- Hindmarsh Shire Council

- Horsham Rural City Council

- Indigo Shire Council

- Latrobe City Council

- Loddon Shire Council

- Macedon Ranges Shire Council

- Mansfield Shire Council

- Mildura Rural City Council

- Mitchell Shire Council

- Moira Shire Council

- Moorabool Shire Council

- Mount Alexander Shire Council

- Moyne Shire Council

- Murrindindi Shire Council

- Northern Grampians Shire Council

- Pyrenees Shire Council

- Borough of Queenscliff

- South Gippsland Shire Council

- Southern Grampians Shire Council

- Strathbogie Shire Council

- Surf Coast Shire Council

- Swan Hill Rural City Council

- Towong Shire Council

- Wangaratta Rural City Council

- Warrnambool City Council

- Wellington Shire Council

- West Wimmera Shire Council

- Wodonga City Council

- Yarriambiack Shire Council

Purchase of a new PPR

A dual PPR exemption is available where an individual owner or eligible trustee purchases new land to be used as a PPR but, as at 31 December of the year before the assessment year, the owner or vested beneficiary has not yet moved out of their existing PPR.

In these circumstances, both the new PPR and old PPR will be exempt from land tax for that assessment year. However, the owner or trustee cannot derive any income from the new PPR while it is not occupied as their PPR in the year preceding the tax year.

This additional exemption may be revoked if the individual owner or vested beneficiary does not move into the new PPR within 12 months of its purchase and use it as their PPR for at least 6 continuous months.

Sale of an old PPR

A dual PPR exemption is also available where an individual owner or vested beneficiary has moved into a new PPR but, as at 31 December of the year before the assessment year, still owned the old PPR.

In this case, both the old and new PPR will be exempt for that assessment year even though the owner or beneficiary is no longer living in the old PPR.

The individual owner or trustee cannot derive any income from the old PPR land while it is not occupied as their PPR in the year preceding the tax year. The exemption may be revoked if the old PPR has not been sold by the end of the assessment year for which the exemption is granted.

Changes in use affecting the PPR exemption

When a person changes how they use their PPR, their eligibility for the exemption can be affected.

Absences from a PPR

A PPR exemption may continue or be granted where the individual owner or vested beneficiary is temporarily absent from their PPR. This may be due, for example, to working interstate or overseas.

For this exemption to apply for a given assessment year, the owner or vested beneficiary must have either obtained a PPR exemption or used the property as their PPR for at least 6 consecutive months immediately before the absence and must satisfy us that:

- the absence is only temporary

- the individual owner or vested beneficiary intends to resume occupation of the PPR after their absence

- no other land in or outside Australia is exempt as their PPR land during their absence

- the rental requirement is satisfied.

Prior to the 2021 land tax year, the rental requirement is satisfied if the owner or trustee did not rent out the land for 6 months or more in the year before the assessment year during the period of absence. This exemption is not available if the individual owner or trustee rents out the land for 6 months or more in the year before the tax year, for all relevant years being claimed.

From the 2021 land tax year, the rental restriction was replaced with a no income requirement. This means the exemption does not apply to a tax year if any income was derived from the land in the year preceding the tax year. For the 2021 tax year, there was a transitional arrangement whereby the owner or trustee could still qualify for the temporary absence PPR exemption if they rented the land for 6 months or less in 2020.

This exemption does not apply if the land was unoccupied due to construction or renovation of a residence on the land.

This exemption is limited to 6 years from the date the absence started.

Absence resulting from family or domestic violence

If you have experienced or are experiencing family or domestic violence, and this has led to you being absent from the property you previously occupied as your home, you may be eligible for ex gratia relief if the following conditions are met:

- the land must be owned solely or jointly by you

- the land was exempt as your PPR prior to your absence

- you left your PPR due to family violence

- no income has been derived from the land (or you can demonstrate that you did not receive any income that was derived from the land) and

- you are not entitled to another PPR exemption during the same period.

Supporting documents required to support your application could include:

- medical documents

- court documents

- police statements/reports

If you would like to discuss your specific circumstances and whether ex gratia relief could be considered, please submit an online enquiry (select the ‘Family and domestic violence’ category) or contact us by phone. If you or someone you know needs help, there are a wide range of family violence support services available.

People who have lost the ability to live independently

The PPR exemption is available where the individual owner or vested beneficiary is absent from their PPR because they can no longer live independently and lives full-time:

- in a hospital as a patient, or

- in a residential care facility, supported residential service or a residential service for people with disabilities, or

- in a Specialist Disability Accommodation (SDA) enrolled dwelling as an SDA resident, or

- with a carer who provides care to the individual owner or resident vested beneficiary on a daily basis.

The exemption does not apply if the person has resided on the land under a right to reside or a person with a disability (qualifying) and they move out of the residence because they have lost the ability to live independently.

The exemption is also subject to the no income requirement referred to under 'Absences from PPR' above

PPR land that becomes unfit for occupation

Where land being used as a PPR becomes unfit for occupation due to damage or destruction caused by a natural disaster (such as a fire, earthquake, or storm), accident or malicious damage, the exemption will continue as if the individual owner or vested beneficiary still uses and occupies the land as their PPR.

The exemption is available for up to 2 years after the date on which the land becomes unfit for occupation as a PPR. This period may be extended for an additional 2 years if the Commissioner is satisfied there has been an acceptable delay beyond the control of the individual owner or eligible trustee.

An exemption for land that is unfit for occupation is not available if other land owned by the individual owner or eligible trustee is eligible for the PPR exemption.

Land tax — exemption for construction or renovation of a PPR (PPR)

An exemption from land tax applies to land on which a PPR (PPR) is being constructed or renovated. You can apply for this exemption if construction or renovation of your PPR completes on or after 1 July 2022.

The exemption is available for up to 4 years from the commencement of the works, with up to a further 2 years available where the builder has gone into liquidation. The landowner or vested beneficiary must commence occupation of the property as their PPR within 6 months of the works finish date. You must notify us in certain circumstances, such as if you fail to move in and live in the property as your PPR within time.

A partial PPR exemption

Partial exemption if land is used for business purposes

Where a substantial business activity is conducted on land being used as a PPR, an exemption will apply only to the portion of the land which is used exclusively for residential purposes by the individual owner, vested beneficiary or the person with the right to reside.

The apportionment is based on either the floor space of a building or land area. The Commissioner may consult with the Valuer-General regarding apportionment.

Partial exemption if a separate residence on PPR land is leased

If the PPR land contains a separate residence on the same title, such as a granny flat or bungalow, which was used to derive income from the provision of accommodation in the year preceding the tax year, then land tax will be assessed on the part of the land that contains the separate residence. The remaining part of the land will be exempt.

The exemption will continue to apply if the owner of the land is only receiving a small or nominal payment for board or lodging, or where a family member merely contributes towards utility costs, maintenance, repairs or similar expenses for the property. These payments would not meet the ordinary legal meaning of the term ‘rental income’.

The exemption will only apply to the part of the land used exclusively for residential purposes by the individual owner, vested beneficiary or person with the right to reside.

Partial exemption or refund for trustees

Where only some of the vested beneficiaries of the trust reside at the PPR land, an exemption or refund will be limited to the proportion of the land which the vested beneficiary, who uses the land as their PPR, has an interest in and does not pay rent to the trustee for use of the land.

Example

Mark and Nicola are the vested beneficiaries in the Red House under a fixed trust. They have equal interests. Only Mark lives there. He is entitled to a land tax exemption on his 50% share of the value of the Red House. Nicola is not entitled to a land tax exemption on her share of the Red House.

Meaning of income

The term 'income' has its ordinary meaning for the purposes of this exemption. Whether a monetary payment is ‘income’ would be determined case by case, based on the facts of the matter. While several factors are relevant, none determines the question of whether a payment constitutes income. Important factors include whether an arrangement has a profit-making character, the relationship between the parties to the arrangement and the scale of any payments being made.

Joint owners and the PPR

For the purposes of the exemption, it does not matter if you own the land jointly with others. If you use and occupy the land as your PPR, your share in the property is exempt.

Land tax exemption: joint owner leaves jointly owned PPR

If a PPR (PPR) is jointly owned, and one of the joint owners moves out of the PPR, they may be eligible for a land tax exemption for up to 2 tax years.

Conditions

Say a home was the PPR of Joint Owners 1 and 2, but Joint Owner 1 moves out of the property.

Joint Owner 1 would not be liable for land tax on their interest in the land in a particular tax year if:

- at any time in the year preceding that tax year, the land was used and occupied as the PPR of Joint Owners 1 and 2, or

- at any time in the second year preceding that tax year, the land was used and occupied as the PPR of Joint Owners 1 and 2, and Joint Owner 1 has no other PPR-exempt land for that particular tax year.

Example

Anna and Jian jointly own the Red House, which they used and occupied as their PPR.

In June 2023, Anna left the Red House and lived at a rental property (the Blue House), where she continues to live as her PPR. Jian continued to live at the Red House as her PPR.

Anna would not be liable for land tax on her interest in the Red House for the 2024 tax year. This is because in the year preceding the 2024 land tax year (being 2023), the Red House was used and occupied by Anna and Jian as their PPR.

Anna also would not be liable for land tax on her interest in the Red House for the 2025 tax year. This is because:

- in the second year preceding the 2025 land tax year (being 2023), the Red House was used and occupied by Anna and Jian as their PPR, and

- Anna had no other PPR-exempt land for the 2025 land tax year, as the Blue House was a rental property.

If Anna continues to jointly own the Red House but live at the Blue House as her PPR, she would be liable for land tax for the 2026 tax year onwards.

If my land is entitled to the 'main residence' exemption from capital gains tax, is it also entitled to the PPR exemption from land tax?

The requirements for the 'main residence' exemption from capital gains tax, which is administered by the Australian Taxation Office, are not the same as those for the PPR exemption, which means that you may not be entitled to both.