GAIC deferral thresholds, indexation and interest

Examples of indexation and interest for deferred GAIC liability.

Deferred GAIC amounts

Depending on the type of land involved (i.e. type A, B or C), and the date of the dutiable transaction, different amounts of GAIC can be deferred. The deferred liability will be subject to indexation from the day the liability arose and interest as set out below.

A person liable to pay a GAIC payment in respect of a dutiable transaction relating to land may elect to defer if the GAIC liability arose:

- Before 30 June 2011:

- up to 100% of the GAIC for type A land, if the dutiable transaction occurred before 1 July 2010

- up to 70% of the GAIC in any other case

- On or after 30 June 2011, up to 100% of the GAIC may be deferred on all types of land.

When is the deferred liability due?

The deferred liability must be paid on or before the first of the following events:

- The issuing of a statement of compliance relating to all or any part of the land.

- The making of a building permit application relating to all or any part of the land.

Prior to this, a liable person may apply for staged payment approval, enabling the liability to be paid, in accordance with that arrangement, subject to the approval from the Minister for Planning.

Indexation and interest

Generally, indexation will apply from the time the liability arises until the first of the following events:

- It is paid by the due date (i.e. before the issuing of a statement of compliance or making a building permit application).

- The land becomes part of a gazetted precinct structure plan (PSP).

After that, the deferred liability, as indexed, is subject to interest until it is paid by the due date or approval is given for a staged payment.

The exception to this is for liabilities incurred in respect of type A land, where the dutiable transaction occurs prior to 1 July 2010. In this case, the deferred liability will be indexed until it is paid or approval is given for a staged payment.

Deferred GAIC indexation

Deferred GAIC is indexed annually at the end of each financial year after the GAIC liability has arisen. Indexation is based on the consumer price index (all groups index for Melbourne) and continues until the first of the following events:

- The deferred liability is paid.

- The land becomes part of a PSP.

- Approval is given for a staged payment.

Interest on deferred GAIC

The interest payable on a deferred GAIC is calculated on a daily basis at the 10-year bond rate.

This rate is the average of the daily yields for the 10-year Treasury Corporation of Victoria (TCV) bond for the month of May in the financial year preceding the financial year in which the day occurs (for example, average daily yields for May 2025 is the rate to be used for the 2025-26 financial year).

The applicable average TCV 10-year bond rate for the 2025-26 year is 5.0871%.

See historical GAIC contribution and interest rates.

Deferred GAIC illustrated examples

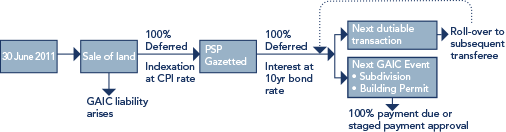

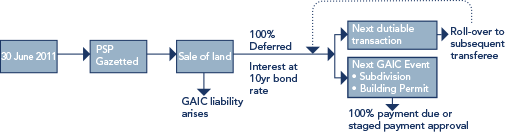

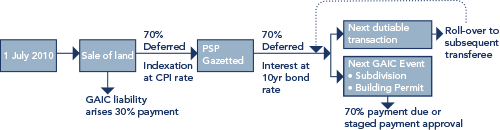

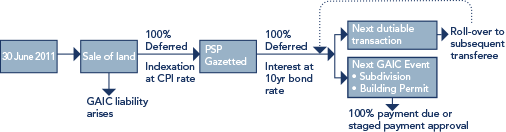

The accompanying diagrams illustrate how, in different scenarios, indexation and interest applies to a deferred GAIC liability in respect of a transfer of land.

These are for illustrative purposes only and do not cover all scenarios. The dotted lines indicate the continuation of indexation/interest in a roll-over situation.

Type A land

1. Dutiable transactions arising before 1 July 2010

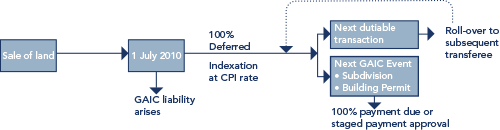

For dutiable transactions that occurred before 1 July 2010, up to 100% of the GAIC liability in respect of that land may be deferred. Any deferred GAIC is indexed until it is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

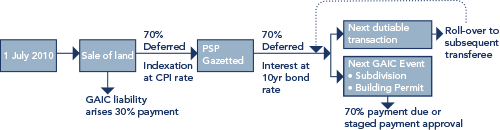

2. Dutiable transactions arising from 1 July 2010 to 29 June 2011 and before the land becomes part of a PSP

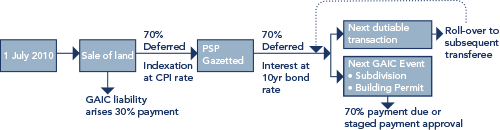

For dutiable transactions that occur on or after 1 July 2010 (and prior to 30 June 2011) but before the land becomes a part of a precinct structure plan (PSP), up to 70% of the liability may be deferred. The deferred GAIC will be subject to indexation until the land becomes a part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP before the deferred GAIC is paid by the due date, the indexed deferred GAIC will be subject to interest from the date the land becomes part of a PSP until the deferred liability is paid or approval is given for a staged payment arrangement, whichever occurs first.

3. Dutiable transactions arising from 1 July 2010 to 29 June 2011 and after the land becomes part of a PSP

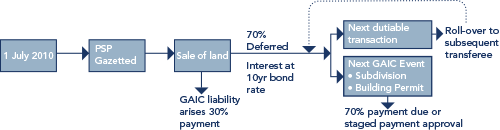

For dutiable transactions that occur on or after 1 July 2010 (and prior to 30 June 2011), but after the land becomes part of a PSP, up to 70% of the GAIC may be deferred. The deferred GAIC will be subject to interest until the deferred GAIC is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

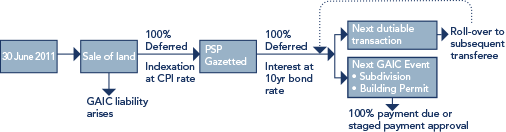

4. Dutiable transactions arising from 30 June 2011 and before the land becomes part of a PSP

For dutiable transactions involving type A land that occur on or after 30 June 2011 but before the land becomes a part of a PSP, up to 100% of the liability may be deferred. The deferred GAIC will be subject to indexation until the land becomes a part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP before the deferred GAIC is paid by the due date, the indexed deferred GAIC will be subject to an interest charge from the date the land becomes part of a PSP until the deferred liability is paid or approval is given for a staged payment arrangement, whichever occurs first.

5. Dutiable transactions arising from 30 June 2011 and after the land becomes part of a PSP

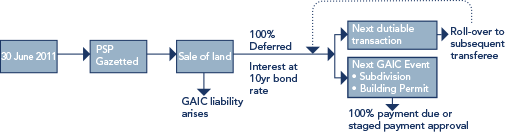

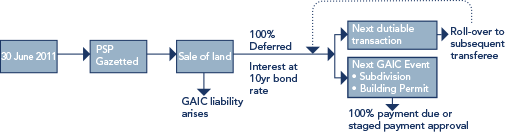

For dutiable transactions that occur on or after 30 June 2011 and after the land becomes part of a PSP, up to 100% of the liability may be deferred. The deferred GAIC will be subject to an interest charge until the deferred GAIC is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

Type B land

Type B-1 and B-2 land was brought into the contribution area via the Planning Scheme Amendment VC 68, which was gazetted on 30 August 2010. The relevant day for type B-1 land is the first announcement day being 2 December 2008. For type B-2 land, the relevant day is the second announcement day, being 19 May 2009.

1. Dutiable transactions arising from 2 December 2008 to 29 June 2011 and before the land becomes part of PSP

For dutiable transactions that occur before the land becomes part of a PSP, up to 70% of the GAIC may be deferred if liability for the event arose between 2 December 2008 and 29 June 2011 (type B-1), or 19 May 2009 and 29 June 2011 (type B-2). The deferred GAIC is indexed until the land becomes part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP area before the deferred GAIC is paid by the due date, the indexed deferred GAIC is subject to interest from the date the land becomes part of a PSP until the deferred liability is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

2. Dutiable transactions arising from 30 June 2011 and before the land becomes part of PSP

For dutiable transactions that take place on or after 30 June 2011 but before the land becomes part of a PSP, up to 100% of the GAIC may be deferred. The deferred GAIC is indexed until the land becomes part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP area before the deferred GAIC is paid by the due date, the indexed deferred GAIC is subject to interest from the date the land becomes part of a PSP until the deferred liability is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

3. Dutiable transactions arising from 30 June 2011 and after the land becomes part of PSP

For dutiable transactions that take place on or after 30 June 2011 and on or after the land becomes part of a PSP, up to 100% of the GAIC may be deferred. It will be subject to interest until the deferred GAIC is paid by the due date or approval for a staged payment arrangement is given, whichever occurs first.

Type C land

Type C land is any land that is not type A, B-1 or B-2 land, which is brought within a growth area and an UGZ on or after 1 July 2010.

1. Dutiable transactions arising from 30 August 2010 to 29 June 2011 but before the land becomes part of PSP

For dutiable transactions that occur before the land becomes part of a PSP, up to 70% of the GAIC may be deferred if liability for the event arose between 30 August 2010 and 29 June 2011. The deferred GAIC is indexed until the land becomes part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP area before the deferred GAIC is paid by the due date, the indexed deferred GAIC is subject to interest from the date the land becomes part of a PSP until the deferred liability is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

2. Dutiable transactions arising from 30 June 2011 but before the land becomes part of PSP

For dutiable transactions that take place on or after 30 June 2011 but before the land becomes part of a PSP, up to 100% of the GAIC may be deferred. The deferred GAIC is indexed until the land becomes part of a PSP or the deferred GAIC is paid by the due date, whichever occurs first. If the land forms part of a PSP area before the deferred GAIC is paid by the due date, the indexed deferred GAIC is subject to interest from the date the land becomes part of a PSP until the deferred liability is paid by the due date or approval is given for a staged payment arrangement, whichever occurs first.

3. Dutiable transactions arising from 30 June 2011 but after the land becomes part of PSP

For dutiable transactions that occur on or after 30 June 2011, but after the land becomes part of a PSP, up to 100% of the liability may be deferred. The deferred GAIC will be subject to interest until the deferred GAIC is paid by the due date or approval is given for staged payment arrangement, whichever occurs first.