Contents

- 1 Acquisition of an economic entitlement

- 2 Required documents

- 3 Completing the Digital Duties Form

- 3.1 Creating a new form

- 3.2 Property details

- 3.3 Change in beneficial ownership

- 3.4 Transferor(s) details

- 3.5 Transaction details

- 3.6 Confirm data and manage invitations

- 3.7 Edit transferee form

- 3.8 Change in beneficial ownership

- 3.9 Transferee(s) details

- 3.10 Transaction details

- 3.11 Apply for a concession/exemption/relief

- 3.12 Sub-sales, nominations and options

- 3.13 Confirm data and manage signatories

- 3.14 Settlement statement

- 4 Lodging with the State Revenue Office

- 5 Payment of duty

1 Acquisition of an economic entitlement

1.1 What is an economic entitlement in relation to land?

An economic entitlement entitles a person to any one or more of the below:

- To participate in the income, rents or profits derived from the land.

- To participate in the capital growth of the land.

- To participate in the proceeds of sale of the land.

- To receive any amount determined by reference to any of the above matters.

- To acquire any entitlement described above.

The relevant land must have an unencumbered value of more than $1 million.

1.2 Is duty payable?

If a person enters into an arrangement in relation to land under which the person is or will be entitled (directly or through another person) to an economic entitlement in relation to the land, that person is taken to have acquired a beneficial ownership interest in the land that is chargeable with duty (as a change in beneficial ownership under Chapter 2 of the Duties Act 2000).

More information is available on the State Revenue Office website:

1.3 How do I lodge for payment of duty?

If an acquisition of an economic entitlement has occurred and a duty liability has arisen, the acquisition must be lodged with the State Revenue Office for a duty assessment and a payment of the duty liability must be made within 30 days of the acquisition.

The following guide will explain the process of lodging for a duty assessment and making a duty payment.

2 Required documents

The following documents are required to be lodged with the State Revenue Office when submitting a duty assessment for the acquisition of an economic entitlement:

- All contracts and agreements surrounding the development and the interest of the parties

- Valuation of the relevant land showing the unencumbered value as at the time the economic entitlement is acquired.

- A Digital Duties Form.

For information on how to prepare the Digital Duties Form for the acquisition of an economic entitlement, refer to section 3 of this guide.

Please ensure you have copies of all the above documents before proceeding to step 4 of this guide.

3 Completing the Digital Duties Form

The Digital Duties Form is an online form which must be submitted to the State Revenue Office for all transactions involving the acquisition of economic entitlements.

3.1 Creating a new form

A person who acquires an economic entitlement in relation to relevant land is taken to have acquired beneficial ownership of the relevant land. Therefore, the Digital Duties Form will need to be completed on the basis that there has been a change of beneficial ownership of the relevant land.

The representative of the ‘disposer of the beneficial ownership’ (as the transferor) will be required to initiate the Digital Duties form and prepare the ‘Transferor Statement’. This will either be the current beneficial owner of the relevant land or a third party transferring the economic entitlements.

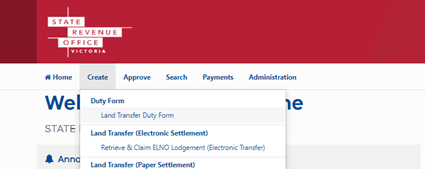

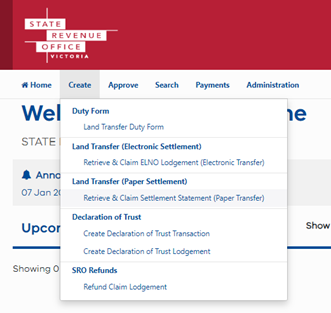

To initiate a Digital Duties Form, select ‘Create’ > ‘Land Transfer Duty Form’ in your Duties Online account.

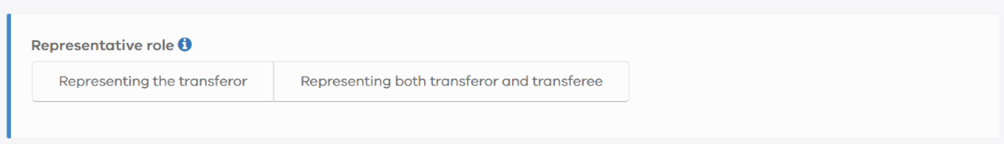

After acknowledging the declaration, you can select your role as the representative:

- ‘Representing the transferor’ – select this option if you are only completing this form on behalf of the party transferring the economic entitlement.

- ‘Representing both transferor and transferee’ – select this option when acting as the representative for all parties involved in the acquisition of the economic entitlement (i.e. the transferor and the acquirer).

3.2 Property details

This section collects information on the particulars of the property(ies) in which the economic entitlements were acquired. All information collected in this section will be shared with the transferee.

Under the question ‘What does this transaction involve?’, select ‘Change in beneficial ownership’.

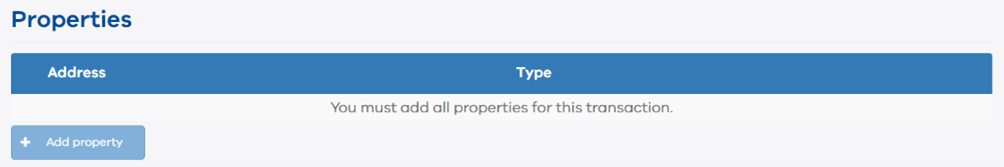

Under ‘Properties’ select ‘+ Add property’ to provide the property type, address and title identifiers of the relevant property(ies) in which the economic entitlements were acquired. You can search for the address or manually enter the address.

It is possible to add multiple land identifiers if the economic entitlements were acquired over multiple properties (e.g. multiple houses along the same street). You must select the ‘+ Add land identifier’ button after every title.

3.2.1 What is the total interest in the property/parcel being transferred?

Where an agreement provides a person with an economic entitlement by reference to a stated percentage and nothing else (e.g. the agreement provides that a developer will obtain a stated percentage of the profits of a project), the interest in the property being transferred will be the stated percentage.

Where the arrangement:

- does not specify a percentage of the economic entitlement, or

- in addition to specifying the percentage of the economic entitlement acquired, also includes any other entitlement of, or payment payable to, the person or an associated person, or

- entitles the person or an associated person to more than one type of economic entitlement.

The person is taken to have acquired an interest in the relevant land of 100% and the interest in the property being transferred is to be listed as 100% in the Digital Duties Form.

Section 3.9 of this guide will demonstrate how the acquirer of the economic entitlement can make submissions requesting the Commissioner of State Revenue to determine that a lesser percentage (than 100%) has been acquired.

3.3 Change in beneficial ownership

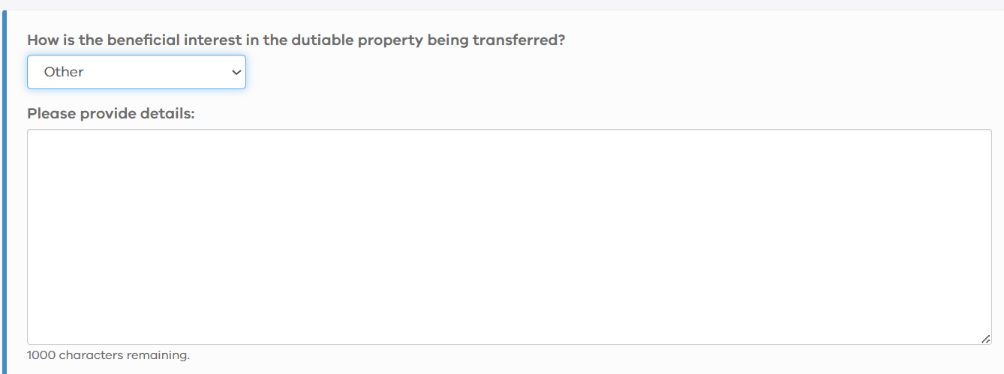

3.3.1 How is the beneficial interest in the dutiable property being transferred?

Select ‘Other’ in the drop-down box.

This will open a free text box which will allow you to provide details of the acquisition of the economic entitlement. This section should list that an economic entitlement has been acquired and the details of how the economic entitlement was acquired (e.g. a development agreement was executed in which the developer is entitled to participate in the income, rents or profits derived from the land).

3.3.2 The land is held in the following structure

Select the structure under which the property is held from the drop-down box. If the correct structure is not in the drop-down box, please select ‘Other’ and list the appropriate structure in the free text box that is created.

3.3.3 The legal title to this property is held by

List the name(s) recorded on the certificate of title as the registered proprietor of the property(ies).

3.4 Transferor(s) details

This section collects information on the transferor, such as their name and contact details, whether they are a foreign person or trustee of a trust. You must ensure that all the information entered is correct.

3.4.1 What is your interest held before the transfer?

This question relates to the percentage of the transferor’s ownership in the relevant property prior to the acquisition of the economic entitlement. If the transferor held a 100% interest in the relevant property prior to the transaction, please select ‘1 of 1 shares’. For any lesser interest, please list the appropriate interest held.

3.5 Transaction details

This section collects information on the transaction, such as whether the parties are related, the contract and transfer dates, and the dutiable value of the property(ies).

All the information collected in this section will be pre-populated into the transferee form.

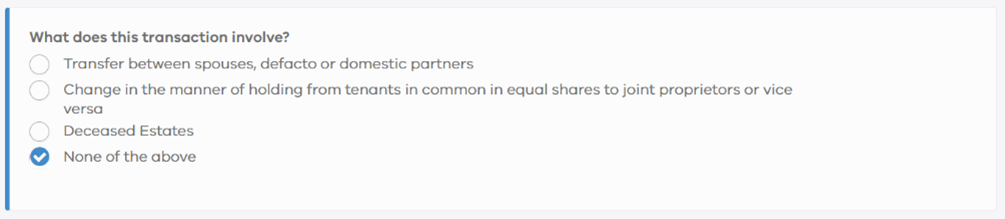

3.5.1 What does this transaction involve?

Please select ‘None of the above’.

3.5.2 ‘Transfer details’ and ‘Consideration and value’

These sections collect data regarding the arrangement under which the economic entitlement was acquired. All data entered will be specific to the transaction at hand.

3.5.3 ‘Sale of business/goods’, ‘Water rights’ and ‘Additional Arrangements’

These sections will ask you to provide details about any sale of business/goods, transfer of water rights or other transactions that may be occurring simultaneously with the acquisition of the economic entitlement. Please fill in these sections as per the transaction at hand.

3.5.4 Off-the-plan/house and land/refurbishment sales

Please select ‘No’ when asked ‘Is this sale subject to an off-the-plan concession?’.

3.6 Confirm data and manage invitations

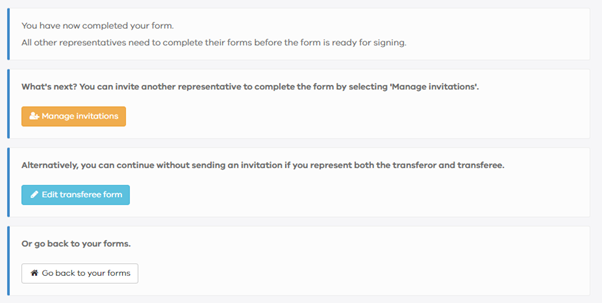

This page in Duties Online contains a summary of key information that has been entered in the transferor form. Click ‘Confirm’ if everything is correct.

You will now be on the ‘Manage invitations’ page where you can invite another representative.

If you represent the transferor and transferee under the transaction, you may select ‘Edit transferee form’ which will allow you to complete the transferee form on behalf of the acquirer of the economic entitlement.

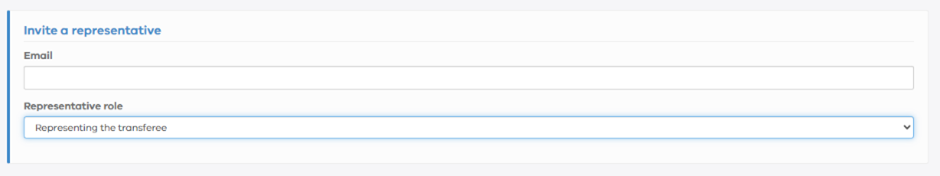

If the transferee is represented by another party, you may invite the representative of the transferee to complete the transferee form by selecting ‘Manage invitations’ and sending an invitation to their email address.

3.7 Edit transferee form

Once you have received an invitation to prepare a transferee form, select ‘Edit transferee form’ to complete the form.

The transferee form starts with the same acknowledgement and property details page as the transferor form. However, you may need to confirm some details (e.g. the value of the property) before proceeding.

Review all the information and, if it is correct, proceed to the next step.

3.8 Change in beneficial ownership

This section will feature the same details as the ‘Change in beneficial ownership’ section listed in the transferor form. You will be unable to edit any of this information in the transferee form. If you have any issues with the information listed in this section, please contact the party that completed the transferor form for any amendments.

3.9 Transferee(s) details

This section collects information on the acquirer, such as their name and contact details, whether they are a foreign person or trustee of a trust, and the percentage interest in the relevant property they are acquiring.

Any transferor who is retaining an interest in the property will automatically appear as a transferee with most of their information already entered. Only the question ‘What is your interest held after the transfer?’ will need to be confirmed.

3.9.1 What is your interest held after the transfer?

Where an agreement provides the transferee with an economic entitlement by reference to a stated percentage, list the stated percentage as the interest held by the transferee following the transfer.

Where the arrangement:

- does not specify a percentage of the economic entitlement, or

- in addition to specifying the percentage of the economic entitlement acquired, also includes any other entitlement of, or payment payable to, the person or an associated person, or

- entitles the person or an associated person to more than one type of economic entitlement.

- the person is taken to have acquired an interest in the land of 100% and ‘1 of 1 shares’ should be listed in the Digital Duties Form.

As part of their submissions, the acquirer of the economic entitlement may request the Commissioner of State Revenue to determine that a lesser percentage (than 100%) has been acquired. These submissions must include:

- submissions as to the appropriate percentage and

- calculations and information in support of the submissions.

Section 4.5 of this guide will demonstrate how to provide these documents to the State Revenue Office for consideration.

3.10 Transaction details

Similar to the ‘Change of beneficial ownership’ page, all information on the transaction details pages has already been entered via the transferor form and cannot be edited under the transferee form.

Review all the information and, if it is correct, proceed to the next step.

3.11 Apply for a concession/exemption/relief

Please select ‘No’ in the question ‘Are you applying for a concession or exemption or relief in relation to this transaction?’.

3.12 Sub-sales, nominations and options

This section will ask you to provide details about any changes to the transfer right under the agreements that may have occurred with the acquisition of the economic entitlement. Please fill in these sections as per the transaction at hand.

3.13 Confirm data and manage signatories

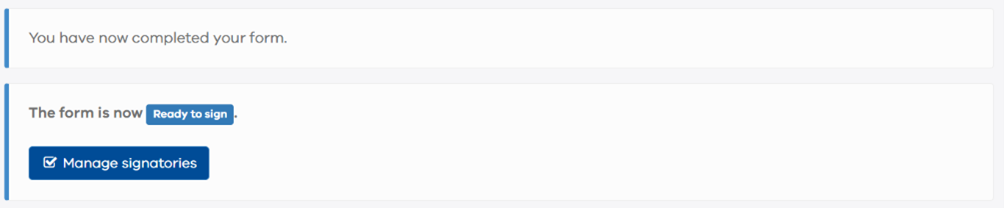

The ‘Confirm’ page shows a summary of the key information already entered. Click ‘Confirm’ if everything is correct.

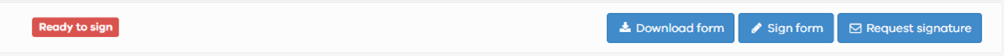

Once all transferor and transferee forms have been completed and the data has been confirmed, the form will enter the ‘Ready to Sign’ status and you will get access to the ‘Manage signatories’ page.

The transferor form and transferee form should be forwarded to the relevant parties by selecting the ‘Request signature’ option and entering their email address.

The signatory can review the information entered and electronically sign the form by making the relevant declarations and selecting the ‘Sign Form’ button.

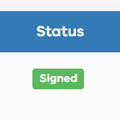

Once the forms have been signed by all parties, it will progress to ‘Signed’ status.

3.14 Settlement statement

Your Digital Duties Form is now completed and ready for lodging. The finalised document is called a settlement statement.

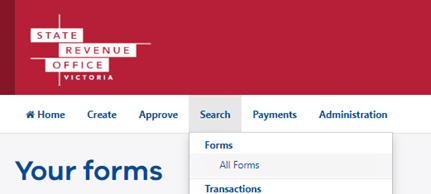

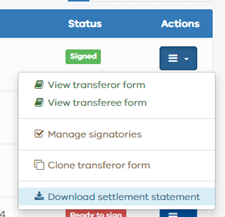

To download a copy of the settlement statement, select ‘Search’ > ‘All Forms’ in your Duties Online account and find the correct transaction.

Select the drop-down arrow under the ‘Actions’ tab and select ‘Download settlement statement’ to download a copy of your settlement statement.

4 Lodging with the State Revenue Office

Once you have gathered the required documents set out in section 2 of this guide, you can submit your lodgement to the State Revenue Office for assessment.

4.1 Create lodgement

To lodge your documents for assessment, please select ‘Create’ > ‘Retrieve and Claim Settlement Statement (Paper Transfer)’ on the home page of your Duties Online account.

4.2 Claim Digital Duties Form

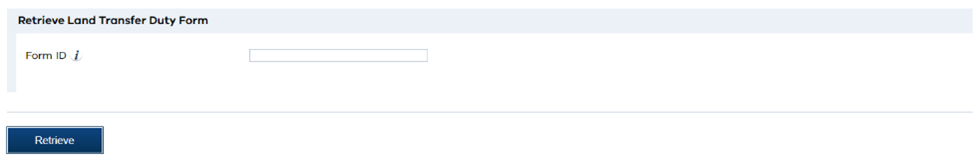

4.2.1 Retrieve Land Transfer Duty Form

Please enter the ‘Duties Form ID’ of the settlement statement for the transaction. This can be found in the top, left-hand corner of the settlement statement.

Once the Duties Form ID has been listed, please click ‘Retrieve’.

4.2.2 Claim Land Transfer Duty Form

Please confirm that the transferor(s) and transferee(s) relate to the correct transaction you an intending to submit. If the details are correct, please input the ‘Settlement Statement Code’. This code can be found in the top, left-hand corner of the settlement statement under the Duties Form ID.

Once the ‘Settlement Statement Code’ has been listed, please click ‘Verify’. You will then have access to select ‘Claim as SRO Land Transfer Lodgement’.

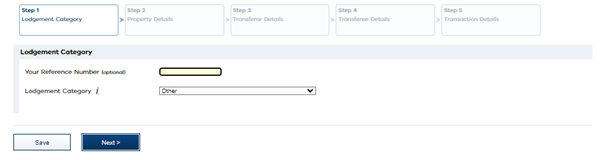

4.3 Lodgement category

Please select ‘Other’ from the drop-down menu.

You will also have the option to list a personal reference number to help you identify this assessment in the future. If left blank, you will still be able to proceed.

4.4 Transaction details

4.4.1 Property details

Review the information regarding the relevant property and, if it is correct, please click ‘Next >’ to proceed to the next step.

4.4.2 Transferor details

Review the information regarding the transferor and, if it is correct, please click ‘Next >’ to proceed to the next step.

4.4.3 Transferee details

Review the information regarding the transferee and, if it is correct, please click ‘Next >’ to proceed to the next step.

4.4.4 Transaction details

Review the information regarding the transaction.

You will also be able to provide any further comments the State Revenue Office in the free text box.

If the information is correct, please click ‘Next >’ to proceed to the next step.

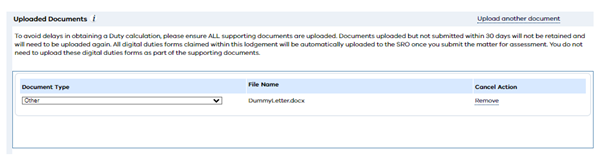

4.5 Upload documents

Please upload all the required documents set out in section 2 of this guide. If you are providing submissions requesting the Commissioner of State Revenue to determine that a lesser percentage (than 100%) has been acquired, please also upload the additional documents noted under section 3.9 of this guide.

To upload a document:

- Select the ‘Document Type’. If your document does not fall within the defined document types, please select ‘Other’.

- Select ‘Choose File’ to locate and select the document stored on your device.

- Select ‘Upload’ to add the file to your lodgement.

After uploading the file, you will see it listed with a ‘Remove’ button next to the file name, which indicates it has been successfully updated.

To upload other documents, select ‘Upload another document’ and repeat the above process.

4.6 Submit the lodgement

Once all supporting documents have been uploaded, please select ‘Submit’ to submit the transaction to the State Revenue Office for a duty assessment.

5 Payment of duty

Under section 16 of the Duties Act 2000, a tax default does not occur for the purposes of the Taxation Administration Act 1997 if duty is paid within 30 days after the liability to pay the duty arises. When a tax default occurs, the Taxation Administration Act 1997 provides for the imposition of penalty tax and interest.

Accordingly, to avoid penalty tax and interest, you must pay the estimated duty at the time of lodgement and within 30 days of acquiring the economic entitlement.

Payments are to be made by EFT. Further guidance on how to make an estimated duty payment can be found at the following link on the State Revenue Office website.