Sub-sales and duty

You may have to pay duty on certain sub-sales of property.

Overview

The sub-sale provisions in the Duties Act 2000 (the Duties Act) provide that a transfer of property may be charged with 2 (or more) lots of duty if there is a sub-sale of the property, such as a nomination, involving additional consideration or land development.

Different rules apply for a transfer of property:

- involving additional consideration or land development, or

- resulting from an option involving additional consideration or land development.

Application of the provisions

Transfers involving additional consideration or land development

The sub-sale provisions apply to a transfer of property where:

- a person (the vendor) enters into a contract (the sale contract) to sell or transfer a property to another person (the first purchaser)

- a subsequent purchaser obtained the right (transfer right) to have the property (or any part of it) transferred to them, on completion of the sale contract (e.g. by nomination or otherwise)

- either of the following occurs:

- the subsequent purchaser or an associate gave or agreed to give additional consideration to obtain the transfer right, or

- land development occurred in relation to the property (or any part of it) between the contract date and transfer date, and

- the vendor transferred the property (or any part of it) to the subsequent purchaser.

Transfers resulting from options

The sub-sale provisions also apply to the transfer of land resulting from options where:

- a vendor grants an option to, or is granted an option by, a person (a first purchaser) to enter into a contract of sale of the property or to transfer the property

- a subsequent purchaser obtained the right, or assumed the obligation, to enter into a sale contract or to have the property (or any part of it) transferred to them (a transfer right)

- either of the following occurs:

- the subsequent purchaser or an associate gave or agreed to give additional consideration to obtain the transfer right, or

- land development occurred in relation to the property (or any part of it) between the grant of the option and transfer date, and

- the vendor transferred the property (or any part of it) to a subsequent purchaser.

For the purpose of the sub-sale provisions, an option is broadly defined and includes a 'put option', 'call option' and 'put and call option' in their usual commercial sense.

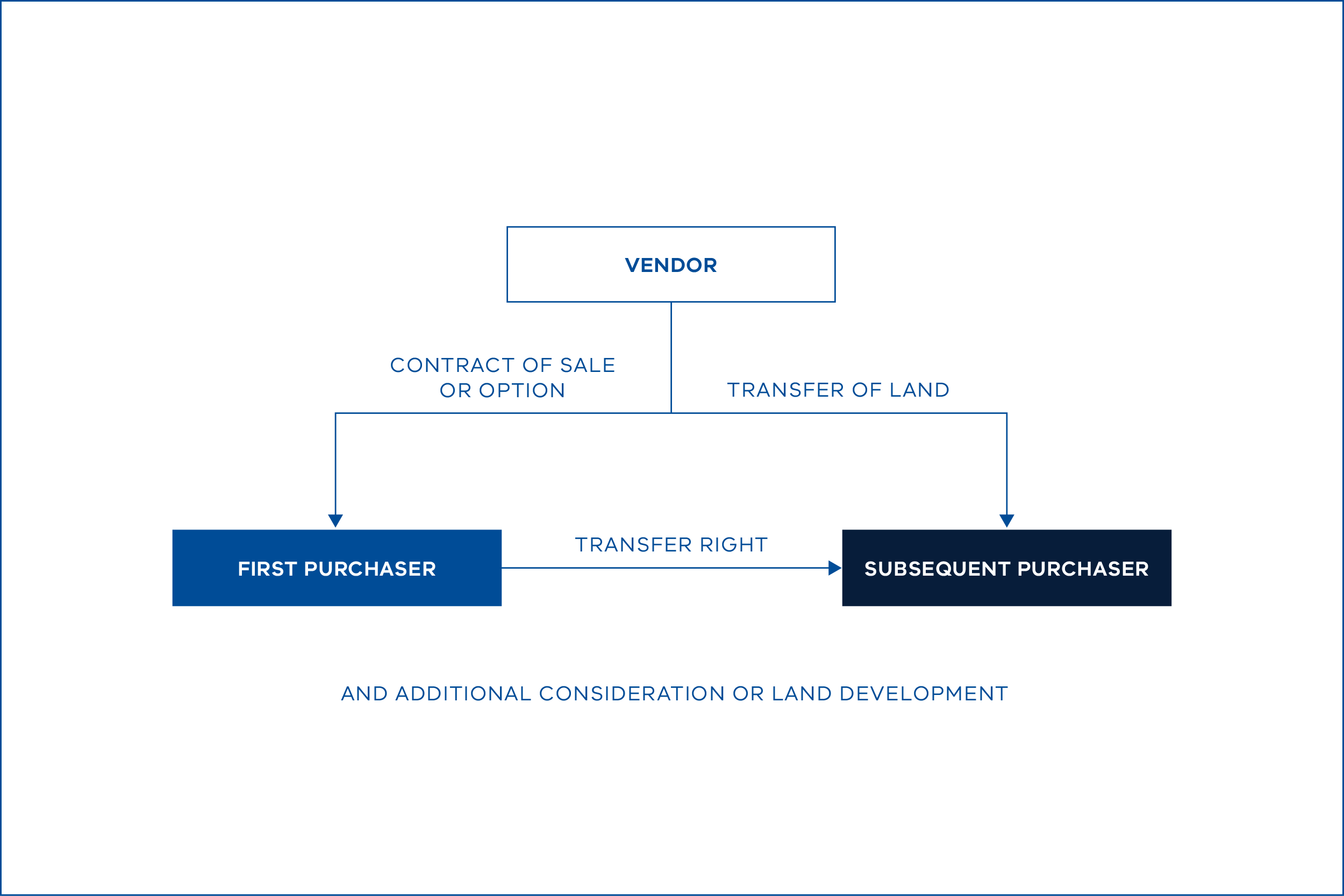

A sub-sale is set out diagrammatically below:

In certain cases, there may be multiple subsequent transactions and multiple subsequent purchasers, such as serial nominations.

How is duty charged under the sub-sale provisions?

Where the sub-sale provisions apply, a transfer of property is charged with 2 (or more) lots of duty. Specifically, duty is separately charged on:

- the dutiable value of the sale contract or option, and

- the dutiable value of each subsequent transaction by which a subsequent purchaser obtained (or assumed) a transfer right (e.g. the nomination).

Who is liable for duty?

This depends. Different purchasers are liable for duty under the sub-sale provisions:

- the first purchaser is liable for duty charged on the sale contract or option, and

- each subsequent purchaser is liable for duty charged on the subsequent transaction by which they obtained their transfer right.

Key definitions and concepts

How does a person obtain a transfer right?

A person typically obtains a transfer right to a property by way of nomination. However, a person can obtain (or assume) a transfer right in several other ways, including by assignment or novation of the sale contract or option. Importantly, a nomination (or other subsequent transaction) will not trigger the sub-sale provisions unless there is additional consideration or land development.

What is additional consideration?

Generally, additional consideration to obtain a transfer right:

- includes monetary or non-monetary consideration that exceeds that which was given or agreed to be given by the first purchaser under the sale contract (or an earlier subsequent purchaser). For example, a nomination fee.

- includes situations where there is a parallel land and building arrangement. Broadly, under these arrangements a first purchaser under the sale contract (e.g. a builder) on-sells land to a person and, around the same time, enters into a second separate contract with the person to build a home on that land. It does not matter if the second separate contract is on arm’s length commercial terms or not.

- excludes the reimbursement of certain costs, such as a deposit payable under the sale contract, legal costs, survey or valuation payments or reasonable selling agents’ fees.

What is land development?

Land development is broadly defined to include several key steps in the land development process, including applying for a planning permit in relation to the use or development of a property. It does not matter if an application for a planning permit is successful or not.

Land development includes any one or more of the following actions:

- Preparing a plan of subdivision or taking any steps to have the plan registered.

- Applying for or obtaining a planning permit in relation to the use or development of the land.

- Requesting a planning authority prepare an amendment to a planning scheme that would affect the land.

- Applying for or obtaining a building permit or approval in relation to the land.

- Doing anything in relation to land for which a building permit or approval would be required.

- Developing or changing the land in any other way that would lead to the enhancement of its value.

For guidance on the actions and activities which the Commissioner of State Revenue considers constitute land development, see Revenue Ruling DA-064v2 — Meaning of Land Development.

If your circumstances are not covered in the ruling, please consider requesting a private ruling.

When will land development trigger an additional duty liability?

The timing of land development (such as applying for a planning permit) and a nomination (or other subsequent transaction) is crucial to determining whether land development will trigger an additional duty liability. Generally, there will be different duty outcomes depending on the timing of land development and the nomination date:

| Timing of land development | Outcome |

|---|---|

| Before contract/option date | No additional duty* |

| Between contract/option date and nomination date | Additional duty** |

| Between nomination date and transfer date | No additional duty (an exclusion applies)* |

* An additional duty liability may still arise if a subsequent purchaser or an associate gave or agreed to give additional consideration to obtain the transfer right.

** This is subject to any exemption or exclusion applying (see below).

There are other situations where land development will not trigger a duty liability on a sale contract or option (or a subsequent transaction if there are serial nominations). These include situations where the consideration given or agreed to be given by the first purchaser under the sale contract or the option included consideration for the land development and the first purchaser (and their associates) did not undertake or participate in the land development at any time before the nomination date.

Exemptions and concessions

The sub-sale provisions include several exemptions and concessions that can apply to an additional duty liability charged under the sub-sale provisions. These include:

- An exemption from duty on a sale contract or option if a subsequent purchaser is either an individual (acting on their own behalf) who is a relative of the first purchaser or the trustee of a fixed trust whose only beneficiaries are individuals who are relatives of the first purchaser.

- An exemption or concession from duty on a sale contract or option if a specified exemption or concession under Chapter 2 of the Duties Act would have been available if the sale contract or option were a transfer of property to the first purchaser. Relevantly, these specified exemptions do not include exemptions relating to trusts or superannuation, such as the apparent purchaser duty exemption.

- From 13 December 2023, an exemption or concession from duty on a sale contract, option, or subsequent transaction in certain circumstances where the transaction would be eligible for a corporate reconstruction exemption or concession if it were a transfer of property between members of a corporate group.

Examples of common situations

The following examples illustrate how the sub-sale provisions apply to 3 common situations.

Example 1 — Applying for a planning permit before nomination

Ben signed a sale contract to purchase a property in Coburg. Shortly after signing the sale contract, he applied for a planning permit to develop the property. Ben subsequently decided that he would prefer to hold the property in a different structure, so he established a new discretionary trust — Ben’s Discretionary Trust (BDT) — which he will control. Ben then nominated the trustee of BDT as the substituted purchaser under the sale contract. At settlement of the sale contract, the property is transferred to the trustee of BDT.

Ben’s application for a planning permit constitutes land development under the Duties Act. As land development has occurred between the contract date and nomination date, the sub-sale provisions will apply to charge 2 lots of duty on the transfer of the property:

- Ben will be liable to pay duty on the dutiable value of the sale contract as if he had completed it.

- The trustee of BDT will be liable to pay duty chargeable on the dutiable value of the nomination.

Alternatively, if Ben had nominated the trustee of BDT before applying for the planning permit (and no additional consideration was provided and no other land development occurred before the nomination date), duty would not have been charged on the dutiable value of the sale contract.

Example 2 — Transfer involving additional consideration

Linh has signed a sale contract to purchase a property in Elwood for $3 million and paid the deposit. Before settlement of the sale contract, she decided that she did not want to purchase the property. Linh nominated Mel as the substitute purchaser in exchange for a nomination fee of $100,000 and a reimbursement of the deposit. At settlement of the sale contract, the property is transferred to Mel.

The reimbursement of Linh’s deposit is not additional consideration as it is an excluded cost. However, Mel has provided additional consideration of $100,000 to obtain the transfer right. Accordingly, the sub-sale provisions will apply to charge 2 lots of duty on the transfer of the property:

- Linh will be liable to pay duty on the dutiable value of the sale contract, being $3 million.

- Mel will be liable to pay duty on the dutiable value of the nomination, being the consideration of $3.1 million that was paid to obtain the property (unless the market value of the property was higher at the nomination date).

Example 3 — Applying for a planning permit before nominating a corporation in the same corporate group

Company A has entered into a sale contract to transfer a property in Box Hill to Company B. Shortly after signing the sale contract, Company B applied for a planning permit to develop the property. Company B decided that it would prefer for one of its wholly owned subsidiaries, Company C, to hold the property and therefore nominated Company C as the substitute purchaser of the property under the sale contract. At settlement, the property is transferred to Company C.

For the purpose of the corporate reconstruction provisions in the Duties Act, Companies B and C are members of a ‘corporate group’ and any transfer of property between the companies would be eligible for a concessional rate of 10% of the duty otherwise payable. Company A is not part of that corporate group.

In this example:

- Company B is liable to pay duty on the dutiable value of the sale contract as if it had completed the contract.

- Company C will be liable to pay duty on the dutiable value of the nomination.

Company C is entitled to a corporate reconstruction concession, which represents a 90% discount of the duty otherwise payable on the nomination. This concession is available because Company B paid duty on the sale contract and Company C’s nomination would have been eligible for a corporate reconstruction concession if it were a transfer of property from Company B to Company C.