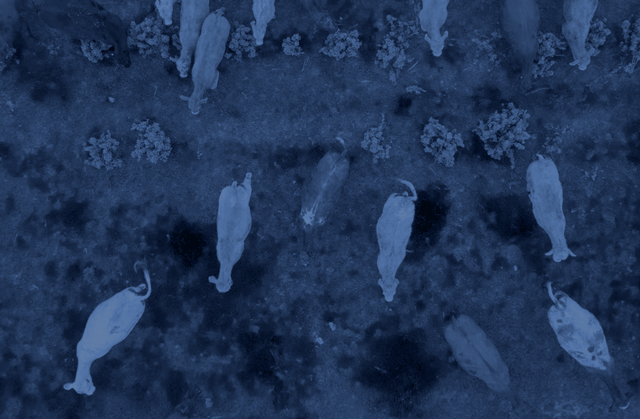

Livestock duty

Duty applies when selling cattle, sheep, goats or pigs.

The Victorian Government has announced a temporary pause on livestock duty from 1 October 2025 to 30 September 2026. This pause applies to duty on cattle, sheep, goats and pigs. You do not need to lodge returns and pay duty to us during this period. Duties-Form-55 is unavailable during the temporary pause period.

What is livestock duty?

Livestock duty is paid on the sale of cattle, sheep, goats and pigs in Victoria. It applies to live animals and carcasses sold via saleyards, paddocks or over-the-hook. There is a temporary pause on this duty from 1 October 2025 to 30 September 2026 due to the prolonged drought.

Understanding livestock duty