If you are an absentee owner, an absentee owner surcharge applies to taxable Victorian land you own. The surcharge is an additional amount that applies over the land tax you pay at general and trust surcharge rates, unless you have been granted a controlling interest exemption.

This surcharge is 4% from the 2024 land tax year (previously 2% for the 2020-2023 land tax years, 1.5% from the 2017-2019 land tax years and 0.5% for the 2016 land tax year).

An absentee owner includes an absentee corporation. If you are an absentee corporation that owns taxable land on 31 December, you must tell us that you are an absentee owner before 15 January the following year. This is important because penalties may apply if you don’t tell us.

What is an absentee corporation?

An absentee corporation is a corporation:

- incorporated outside Australia, or

- in which an absentee person(s) has a controlling interest.

Controlling interest

An absentee person has a controlling interest where they either alone, or acting together with another absentee person:

- holds more than 50% of the shares in the absentee corporation

- can control the composition of the board of the corporation

- can cast more than 50% of the maximum number of votes at the corporation’s general meeting.

The absentee person with a controlling interest can be an absentee corporation, a trustee of an absentee trust or an absentee individual.

In deciding whether an absentee person has, or absentee persons acting together have, a controlling interest in a corporation, you must look at all absentee persons who are able to exercise a controlling interest over the corporation.

Example 1

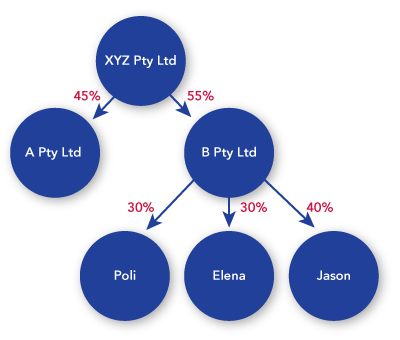

XYZ Pty Ltd is a company that is incorporated in Australia and owns taxable land in Victoria.

XYZ Pty Ltd has 2 shareholders, A Pty Ltd which holds 45% of the shares and B Pty Ltd which holds 55% of the shares. Both A Pty Ltd and B Pty Ltd are incorporated in Australia.

B Pty Ltd has 3 shareholders, Poli who holds 30%, Elena who holds 30% and Jason who holds 40%. Poli and Elena are both absentee individuals.

Poli and Elena together have a controlling interest in B Pty Ltd as together they have 60% of shares. Therefore, B Pty Ltd is an absentee corporation. B Pty Ltd, in turn, has a controlling interest in XYZ Pty Ltd as it holds 55% of the shares. Therefore, XYZ Pty Ltd is also an absentee corporation.

The diagram below illustrates this example.

Land tax groups with absentee corporations

Absentee corporations may be part of a land tax group. Where all members of a land tax group are absentee corporations, the absentee owner surcharge will apply to all land held by the members of the land tax group. Where only some members of a land tax group are absentee corporations, the absentee owner surcharge only applies on the total taxable value of land held by the absentee corporations.

Example 2

Company A, Company B and Company C are part of a land tax group. Company A is an absentee corporation. The three companies own the following taxable Victorian land as at 31 December:

- Company A owns Victorian land with a taxable value of $1,000,000.

- Company B owns Victorian land with a taxable value of $500,000.

- Company C owns Victorian land with a taxable value of $500,000.

The total taxable value of land held by the land tax group is $2,000,000.

The amount of land tax payable by the land tax group is calculated as follows:

- Step 1: determine the amount of land tax payable at the general rate of tax on the total taxable value of land held by the land tax group (i.e. $2,000,000).

The general rate of tax for land with a taxable value between $1,800,000 and $3,000,000 is $11,850 plus 1.65% of the amount greater than $1,800,000.

The tax payable is $11,850 + (($2,000,000 - $1,800,000) × 1.65%)) = $15,150.

- Step 2: the taxable value of the land owned by the absentee corporation × 4% (i.e. $1,000,000 × 4% = $40,000).

- Step 3: Total tax assessed is $15,150 + $40,000 = $55,150.

As all members of a land tax group are jointly liable for land tax owed by the group, we are able to recover land tax from any member of the group, including the land tax assessed at the surcharge rate.

Tell us that you are an absentee owner

If you are an absentee owner at 31 December, you must tell us before 15 January of the following year.

There are 2 ways you can notify us:

- A person representing the land tax group (using the land tax group’s customer number) can notify us on behalf of each member of the group.

- Each member of the land tax group can notify us separately.

Changes to your absentee owner status

Notify us of any change in your absentee owner status by updating your details through our Absentee Owner Notification Portal.

Controlling interest exemption

An absentee person who holds a controlling interest in an absentee corporation may, in some circumstances, be eligible for an exemption. The effect of the exemption is that the absentee person, who holds a controlling interest in the absentee corporation, is taken to not hold that controlling interest. The result is the corporation that owns the land will not be considered an absentee corporation, and therefore will be exempt from the absentee owner surcharge.

The exemption is only available to an absentee person who holds a controlling interest in a corporation that is incorporated in Australia and owns land in its own right.

The exemption is intended to apply to those corporations which conduct a commercial operation in Australia and whose commercial activities make a strong and positive contribution to the Victorian economy and community by engaging local labour and using local materials and services through an Australian-based entity.

The Treasurer's guidelines, published in the Government Gazette, outline the basis on which exemption decisions are made. Before you apply for an exemption, you should refer to the relevant guidelines to determine whether you are eligible for the exemption:

- For exemption applications relating to 2016 and 2017 land tax years, refer to the Treasurer's guidelines issued on 11 August 2015.

- For exemption applications relating to the 2018 land tax year, refer to the Treasurer's guidelines issued on 5 January 2018, which were issued after a scheduled review. These guidelines include the criteria for absentee trusts.

- For exemption applications relating to the 2019 land tax year onwards, refer to the Treasurer's guidelines issued on 1 October 2018. These guidelines were issued to include examples of how build-to-rent developments may qualify for the exemption. The exemption will cease to apply when the build-to-rent development is completed, as the absentee corporation or the trustee of the absentee trust will then be considered a passive investor or landlord.