Constructive ownership of land holdings through linked entities (landholder provisions)

Ruling number: DA-058

Ruling history

| Ruling number | DA-058 |

|---|---|

| Status | Current |

| Issue date | 01 July 2012 |

| Issued by | Commissioner of State Revenue |

This ruling explains the operation of the constructive ownership provisions in relation to linked entities.

Preamble

The landholder provisions in Part 2 of Chapter 3 of the Duties Act 2000 (the Act) charge duty on relevant acquisitions in landholders.

A landholder is any company or unit trust scheme (whether private or public) that has land holdings in Victoria with an unencumbered value of $1 million or more.

In determining whether a company or unit trust scheme is a landholder (and the amount of duty payable on a relevant acquisition), the company or unit trust scheme’s land holdings are not limited to land directly held by the company or on behalf of the unit trust scheme. In certain circumstances, they may include land held by linked entities and discretionary trusts.

Section 75 of the Act provides for the constructive ownership of land through linked entities. A linked entity is defined in section 75 of the Act to mean any person or body, corporate or unincorporated, that may hold property in its own right or for the benefit of any person. The definition of a linked entity includes a trust but does not include a natural person.

Under section 75 of the Act, a company or unit trust scheme (including a landholder) may be considered to be entitled to land held by a linked entity or a chain or web of linked entities. However, a company or unit trust scheme will not be taken to be entitled to the land of linked entities unless it has an entitlement to at least 20% of the land on a winding up of all the relevant linked entities.

For the purposes of section 75 of the Act, a company or unit trust scheme is taken to be entitled to land through a linked entity or linked entities, if on the winding up of all linked entities and without regard to any liabilities of the linked entities, the company or unit trust scheme would receive a distribution of any of the property held by any of the linked entities. The interest in land the company or unit trust scheme is taken to be entitled to in such circumstances is determined by reference to the proportion of the property of the relevant linked entity or linked entities the company or unit trust scheme would be entitled to receive upon a winding up of all the linked entities.

Where a company or unit trust scheme is taken to be entitled to at least 20% of the land through a linked entity or a chain or web of linked entities, the value of the interest in land that the company or unit trust scheme is considered to hold through such entities is that portion of the unencumbered value of the land which is equivalent to the portion of the unencumbered value of the property to which the company or unit trust scheme would be entitled (without regard to any liabilities of the linked entities) on a winding up of all the linked entities.

Winding up of a linked entity is defined in section 75 of the Act to include any means by which the entity’s property is divested in favour of the persons entitled to it and, in the case of a linked entity that is a trust, includes the vesting of the trust property in the beneficiaries.

The purpose of this Revenue Ruling is to explain the operation of the constructive ownership provisions in relation to linked entities. This Ruling does not deal with the constructive ownership of land through discretionary trusts. For information on the tracing of land through discretionary trusts, please see Revenue Ruling DA.059.

Ruling

An entity can be linked to a company or unit trust scheme (including a landholder) whether or not the company or unit trust scheme holds a direct interest in the entity. If a company or unit trust scheme does not hold a direct interest in an entity, the entity may be a linked entity of the company or unit trust scheme provided it is linked to other entities linked to the company or unit trust scheme or to each other. An entity can be linked to a company or unit trust scheme no matter how many interposed entities exist between it and the company or unit trust scheme.

Even though a company or unit trust scheme may not hold a direct interest in a linked entity, it may be taken to be entitled to the land of the linked entity. This is because a company or unit trust scheme’s entitlement to the land of a linked entity is based on its entitlement to receive a distribution of property on a winding up of all relevant linked entities and not necessarily to the interest it holds in any of the linked entities.

A company or unit trust scheme’s entitlement to receive a distribution of property on a winding up of all relevant linked entities is determined on the basis of a notional winding up of all the linked entities at the time of an acquisition of an interest in the company or unit trust scheme. This determination is to be made without regard to any of the liabilities of linked entities at that time. It is also to be made on the basis that the winding up of linked entities includes any means by which the entities’ property is divested in favour of the person(s) ultimately entitled to receive it. This stipulation is a statutory fiction about entitlement to property, not the consequences of actual winding up. It is just the means by which the property of a linked entity is attributed to another company or unit trust scheme (including a landholder): Snowy Hydro Ltd v Commissioner of State Revenue [2010] VSC 221; 79 ATR 118 at 129.

Consequently, a company or unit trust scheme’s entitlement to receive a distribution of property through linked entities is not a reference to what it would actually receive in monetary terms (if anything). Rather, it is a reference to what the company or unit trust scheme would be entitled to receive as a proportional interest in the property of any of the linked entities if such property was to be distributed to the person(s) ultimately entitled to receive it on a winding up of all the linked entities. Whatever that interest amounts to determines the extent of the interest in land to which the company or unit trust scheme is taken to be entitled through the linked entities. The fact that such a distribution of property and land is unlikely to occur is not relevant for the purposes of section 75 of the Act.

However, a company or unit trust scheme will not be considered to be entitled to the land of a linked entity or a chain or web of linked entities unless it has an entitlement to at least 20% of the land on a winding up of all the relevant linked entities. Where the company or unit trust scheme is entitled to at least 20% of the land of a linked entity or a chain or web of linked entities, the value of the land that the company or unit trust scheme is considered to hold through linked entities is that portion of the unencumbered value of the land which is equivalent to the portion of the unencumbered value of the property to which the company or unit trust scheme would be entitled on a notional winding up of all the relevant linked entities.

The examples below illustrate the operation of the constructive ownership provisions and the 20% threshold in the context of both chain and web linked entity structures.

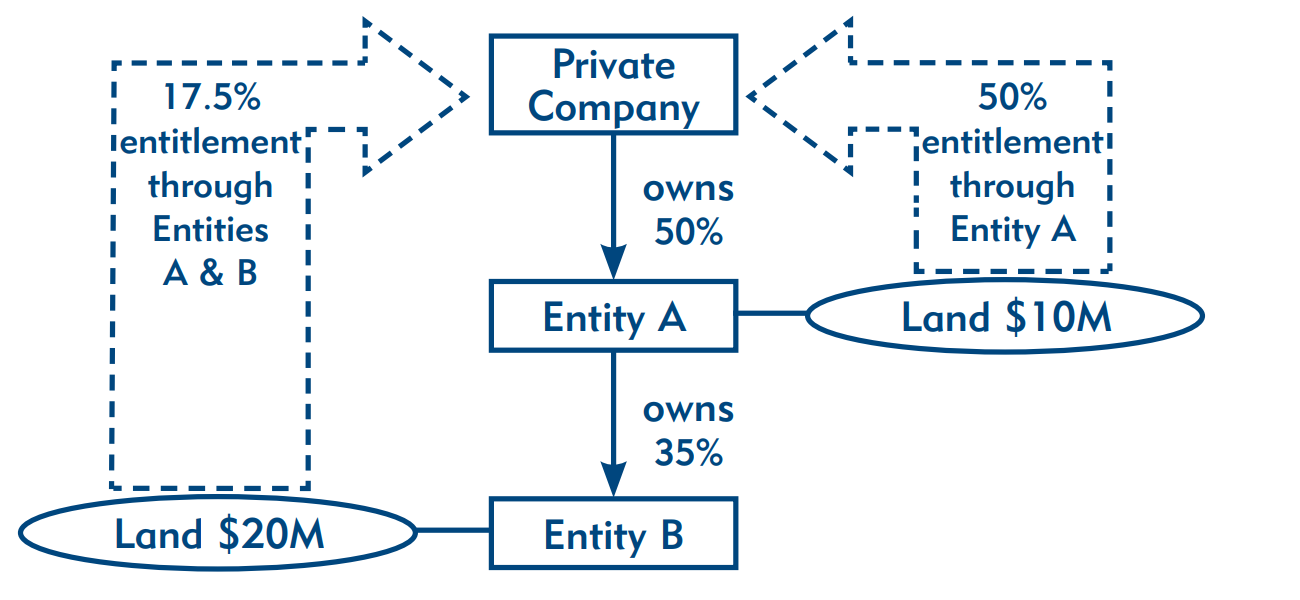

Example 1 – Chain Structure

In Example 1, a private company owns a 50% interest in Entity A which owns a 35% interest in Entity B. Both Entities A and B separately own land in Victoria. The land owned by Entity A is valued at $10 million and the land owned by Entity B is valued at $20 million. Under the constructive ownership provisions, Entities A and B are linked entities of the private company. If Entities A and B were wound up, the private company would be entitled to receive 50% of the property owned by Entity A and 17.5% (50% x 35%) of the property owned by Entity B. Accordingly, the private company is taken to be entitled to 50% of the land owned by Entity A and 17.5% of the land owned by Entity B. As the private company is entitled to at least 20% of the land owned by Entity A, the constructive ownership provisions would operate to deem the private company to be entitled to a 50% interest in land owned by Entity A, valued at $5 million (50% of $10 million). The private company will not be considered to be entitled to any interest in the land owned by Entity B because its entitlement to receive property from Entity B on a winding up of all relevant linked entities (i.e. Entities A and B) is less than 20%. Accordingly, the private company’s interest in the land owned by Entity B (17.5%, which equates to a value of $3.5 million) will not be taken into account in determining whether it is a landholder and/or the amount of duty payable on any relevant acquisition in the private company.

Example 1 illustrates that in a chain structure, if a company or unit trust scheme indirectly holds an interest of less than 20% in any one particular entity in the chain (even though entities linked to the company or unit trust scheme directly or indirectly hold at least 20%), the company or unit trust scheme’s entitlement to the property on a winding up of that linked entity and entities below that point will be less than 20%. In such circumstances, the land of those linked entities will not be taken into account in determining whether the company or unit trust scheme is a landholder and/or the amount of duty payable on any relevant acquisition in the company or unit trust scheme.

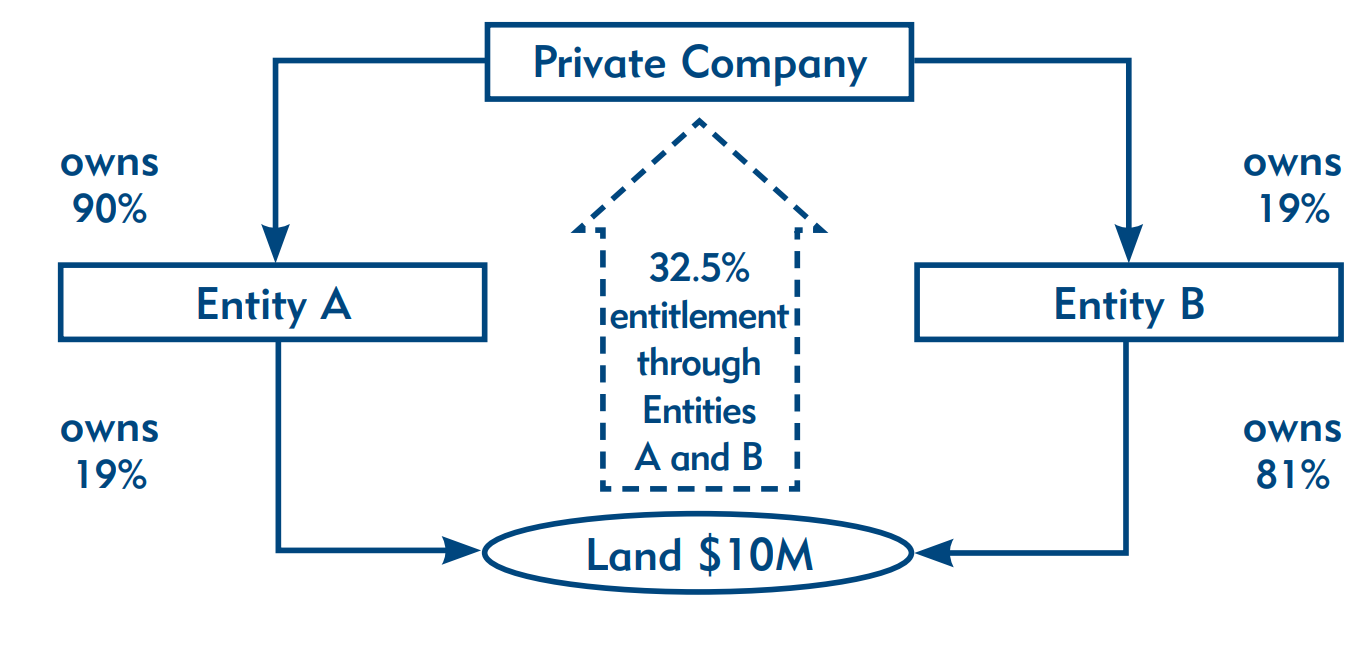

Example 2 – Web Structure

In Example 2, a private company owns a 90% interest in Entity A and a 19% interest in Entity B. Entities A and B respectively own a 19% and an 81% interest in Victorian land valued at $10 million. Under the constructive ownership provisions, Entities A and B are linked entities of the private company. If Entities A and B were wound up, the private company would be entitled to receive 90% of the property owned by Entity A and 19% of the property owned by Entity B. Consequently, the private company is taken to be entitled to a 32.5% interest in the land through Entities A and B (being the aggregate of a 17.1% interest [90% x 19%] through Entity A and 15.4% interest [19% x 81%] through Entity B). As the private company is entitled to at least 20% of the land owned by Entities A and B on a winding up of both entities, the constructive ownership provisions would operate to deem the private company to be entitled to a 32.5% interest in the land, valued at $3.25 million (32.5% of $10 million). Accordingly, this deemed land holding will form the basis of determining whether the private company is a landholder and the amount of duty payable on any relevant acquisition in the private company.

Example 2 illustrates that in a web structure, even if a company or unit trust scheme is entitled to an interest of less than 20% through any one particular linked entity or chain of linked entities, the value of the land of that linked entity or chain of entities may still be traced through to the company or unit trust scheme as a result of all other linked entities or chains of entities being wound up. This is because it is necessary to calculate the ultimate entitlement the company or unit trust scheme has in the land through a distribution of the property of all linked entities, and not just through one linked entity or chain of entities.

Further Assistance If you require advice on the interpretation and application of Part 2 of Chapter 3 of the Act in relation to your particular circumstances, you may contact the Landholder Acquisitions Branch at the State Revenue Office or apply for a private ruling in accordance with Revenue Ruling GEN.009. In all cases, you bear the onus to provide the Commissioner with the necessary information to enable an informed decision to be made.

Disclaimer

Rulings do not have the force of law. Each decision made by the State Revenue Office is made on the merits of each individual case having regard to any relevant ruling. All rulings must be read subject to Revenue Ruling GEN-001.