Absentee chain of trusts (sub-trusts)

Examples of how the surcharge applies to a chain of trusts.

How is the surcharge calculated?

A chain of trusts exists where the beneficiary of a trust is a trustee of another trust. From the 2018 land tax year, there is a change to how the absentee owner surcharge is calculated for land held under a trust that is in a chain of trusts where there is an absentee beneficiary.

Where a chain of trusts exists, the absentee owner surcharge is calculated on the absentee proportion of interests in the land subject to a trust. This is the proportion of all the interests in the trust land that:

- an absentee natural person or an absentee corporation has in that land, directly or indirectly through one or more chains of trusts, that they do not hold on trust for another person

- a person has in the land, directly or indirectly through one or more chains of trusts, as trustee of an absentee trust that is a discretionary trust (this is because a beneficiary of a discretionary trust does not have a quantifiable interest in the trust).

In calculating the absentee proportion of interests in land, a unit holding in a unit trust is to be treated as an interest in the land which is held directly or indirectly by the unit trust. The absentee proportion does not apply to the ultimate trust in the chain of trusts. The ultimate trust is the trust at the end of the chain, that is, the trust that does not have beneficiaries that are a trustee of another trust.

Examples

These are examples of how the absentee beneficiary’s proportion of interests in the land subject to a trust is calculated.

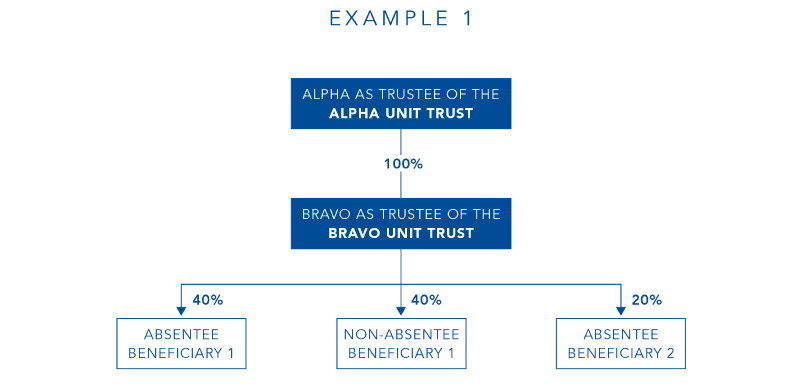

Example 1

Alpha, as trustee for the Alpha Unit Trust, and Bravo, as trustee for the Bravo Unit Trust, are absentee trusts and are in of a chain of trusts. The absentee proportion of interests in land subject to the Alpha Unit Trust is calculated as follows:

- Step 1: calculate Absentee Beneficiary 1’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 1’s interest in the Bravo Unit Trust (40%) by the interest held by Bravo as trustee of the Bravo Unit Trust in the Alpha Unit Trust (100%), i.e. 40% × 100% = 40%.

- Step 2: calculate Absentee Beneficiary 2’s indirect interest in the land. This is determined multiplying Absentee Beneficiary 2’s interest in the Bravo Unit Trust (20%) by the interest held by Bravo as trustee of the Bravo Unit Trust in the Alpha Unit Trust (100%), i.e. 20% × 100% = 20%.

- Step 3: add the amounts determined under step 1 and step 2, i.e. 40% + 20% = 60%.

The Bravo Unit Trust is the ultimate trust in the chain. If it is necessary to determine the absentee owner surcharge payable by Bravo as trustee of the Bravo Unit Trust (for example, if Bravo owns other land as trustee of the Bravo Unit Trust), the surcharge is calculated in the normal manner, which is based on the interests in the land held by the absentee beneficiaries, which is 60%.

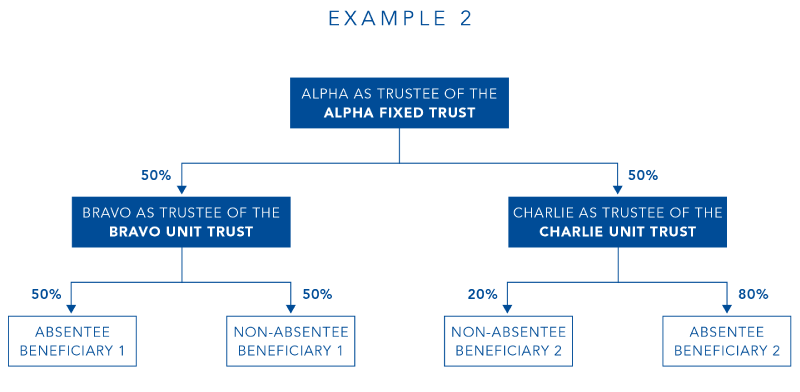

Example 2

Alpha, as trustee of the Alpha Fixed Trust, and Bravo, as trustee of the Bravo Unit Trust, and Charlie, as trustee of the Charlie Unit Trust, are all absentee trusts and are in a chain of trusts. The absentee proportion of interests in land subject to the Alpha Trust is calculated as follows.

- Step 1: calculate Absentee Beneficiary 1’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 1’s interest in the Bravo Unit Trust (50%) by the interest held by Bravo as trustee of the Bravo Unit Trust in the Alpha Fixed Trust (50%), i.e. 50% × 50% = 25%.

- Step 2: calculate Absentee Beneficiary 2’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 2’s interest in the Charlie Unit Trust (80%) by the interest held by Charlie as trustee of the Charlie Unit Trust in the Alpha Fixed Trust (50%), i.e. 80% × 50% = 40%.

- Step 3: add the amounts determined under step 1 and step 2, i.e. 25% + 40% = 65%.

The Bravo Unit Trust and the Charlie Unit Trust are both ultimate trusts. If it is necessary to calculate the absentee owner surcharge payable by Bravo, as trustee of the Bravo Unit Trust, and Charlie, as trustee of the Charlie Unit Trust (if, for example, Bravo and Charlie each own other land as trustee of their respective trusts), the surcharge is calculated in the normal manner. In the case of the Bravo Unit Trust, the surcharge is calculated on 50% of the land. In the case of the Charlie Unit Trust, the surcharge is calculated on 80% of the land.

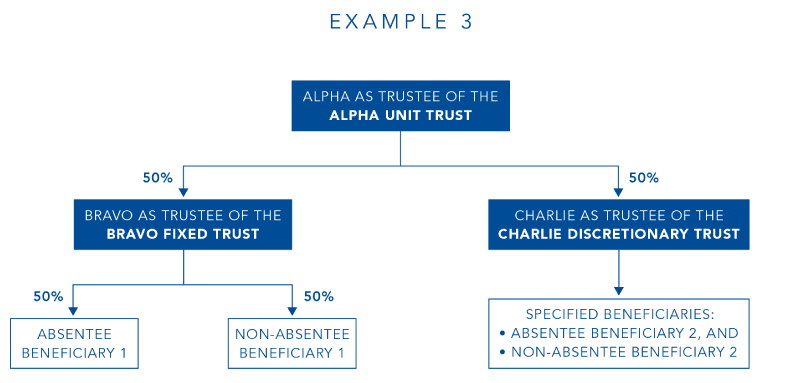

Example 3

Alpha, as trustee of the Alpha Unit Trust, and Bravo, as trustee of the Bravo Fixed Trust, and Charlie as trustee of the Charlie Discretionary Trust are all absentee trusts and are in a chain of trusts. The absentee proportion of interests in land subject to the Alpha Unit Trust is calculated as follows.

- Step 1: calculate Absentee Beneficiary 1’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 1’s interest in the Bravo Fixed Trust (50%) by the interest held by Bravo as trustee of the Bravo Unit Trust in the Alpha Fixed Trust (50%), i.e. 50% × 50% = 25%.

- Step 2: identify the indirect interest in the land held by Charlie as trustee for the Charlie Discretionary Trust (which is an absentee trust because one of its specified beneficiaries is an absentee beneficiary). This is determined by identifying the interest held by Charlie as trustee for the Charlie Discretionary Trust in the Alpha Unit Trust, i.e. 50%.

- Step 3: add the amounts determined under step 1 and step 2, i.e. 25% + 50% = 75%.

The Bravo Fixed Trust and the Charlie Discretionary Trust are both ultimate trusts. If it is necessary to calculate the absentee owner surcharge payable by Bravo, as trustee of the Bravo Unit Trust, and Charlie, as trustee of the Charlie Discretionary Trust (if for example, Bravo and Charlie each own other land as trustee of their respective trusts), the surcharge is calculated in the normal manner. In the case of the Bravo Fixed Trust, the surcharge is calculated on 50% of the land. In the case of the Charlie Discretionary Trust, the surcharge is calculated on 100% of the land.

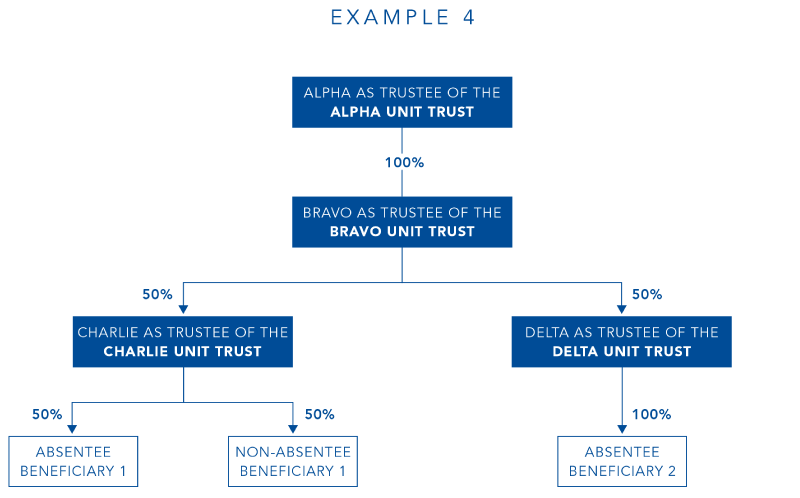

Example 4

Alpha as trustee of the Alpha Unit Trust, Bravo as trustee of the Bravo Unit Trust, Charlie as trustee of the Charlie Unit Trust and Delta, as trustee of the Delta Unit Trust, are all absentee trusts and are part of a chain of trusts. The absentee proportion of interests in land subject to the Alpha Unit Trust is calculated as follows.

- Step 1: calculate Absentee Beneficiary 1’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 1’s interest in the Charlie Unit Trust (50%) by the interest held by Charlie as trustee of the Charlie Unit Trust in the Bravo Unit Trust (50%) by the interest held by Bravo as trustee of the Bravo Unit Trust in the Alpha Unit trust (100%), i.e. 50% × 50% × 100% = 25%.

- Step 2: calculate Absentee Beneficiary 2’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 2’s interest in the Delta Unit Trust (100%) by the interest held by Delta, as trustee of the Delta Unit Trust, in the Bravo Unit Trust (50%) by the interest held by Bravo, as trustee of the Bravo Unit Trust, in the Alpha Unit Trust (100%), i.e. 100% × 50% × 100% = 50%.

- Step 3: add the amounts determined under step 1 and step 2, i.e. 25% + 50% = 75%.

If it is necessary to calculate the absentee owner surcharge for the Bravo Unit Trust, because for example Bravo owns other land as trustee of the Bravo Unit Trust, the absentee proportion is calculated as follows.

- Step 1: calculate Absentee Beneficiary 1’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 1’s interest in the Charlie Unit Trust (50%) by the interest held by Charlie, as trustee of the Charlie Unit Trust, in the Bravo Unit Trust (50%), i.e. 50% × 50% = 25%.

- Step 2: calculate Absentee Beneficiary 2’s indirect interest in the land. This is determined by multiplying Absentee Beneficiary 2’s interest in the Delta Unit Trust (100%) by the interest held by Delta, as trustee of the Delta Unit Trust, in the Bravo Unit Trust (50%), i.e. 100% × 50% = 50%.

- Step 3: add the amounts determined under step 1 and step 2, i.e. 25% + 50% = 75%.

The Charlie Unit Trust and the Delta Unit Trust are both ultimate trusts. If it is necessary to calculate the absentee owner surcharge payable by Charlie, as trustee of the Charlie Unit Trust, and Delta, as trustee of the Delta Unit Trust (if for example, Charlie and Delta each own other land as trustee of the respective trust), the surcharge is calculated in the normal manner. In the case of the Charlie Unit Trust, the surcharge is calculated on 50% of the land. In the case of the Delta Unit Trust, the surcharge is calculated on 100% of the land.