SmartForm tips

Tips for starting, saving, navigating and submitting online forms.

Starting a SmartForm

- The Explanatory Notes section on a SmartForm’s webpage explains key terms and other information to help you complete the form.

- The first page outlines what the form is for, who should complete it and how it is lodged.

- The ‘New form’ selection launches a new SmartForm, while the ‘Saved Form’ selection lets you resume a form you’ve already started.

Navigating a SmartForm

- Use the ‘Previous’ and ‘Save and next’ buttons to navigate through a SmartForm in page order.

- Don’t use the ‘Back’, ‘Forward’ or ‘Refresh’ buttons on your internet browser as you may lose the data you’ve already entered.

Saving a SmartForm

- SmartForms don’t save automatically. The ‘Save and next’ button lets you save your form to complete later. You need to ensure that all relevant information on that page has been entered as required to save the form.

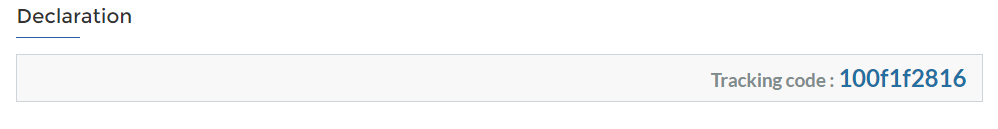

- Record your tracking code as you need it to access your saved SmartForm. This code is unique to each application and is not recorded by the State Revenue Office.

Submitting your SmartForm

- Some SmartForms and attachments can be lodged online. Others need to be printed, signed and submitted by email or post. Lodgement requirements for each SmartForm are outlined on the landing page linking you to the SmartForm.

- In order for your application to be processed, SmartForms and supporting documents must be lodged together.

- Some SmartForms submitted online require supporting documents to be attached. This is done in one of 2 ways, depending on the particular form:

- Most forms will ask you to attach documents within the form itself and before you select ‘Submit’.

-

Some forms will ask you to attach documents after you’ve completed the form and selected ‘Submit’.